When you are first diagnosed with a critical illness, it’s only natural to think about how it impacts your life at that moment and what you can do to mitigate it. However, the effects of critical illnesses such as cancer, heart attack or a stroke can often linger far into the future.

Read on to find out about the potential hidden costs of critical illnesses, primarily what to look out for and how you can protect yourself.

What are the immediate costs of critical illness?

The most obvious cost associated with a critical illness diagnosis is none other than the medical cost. This includes hospitalisation fees, the cost of medicine and other types of treatment, whether it’s chemotherapy for cancer patients or physiotherapy for stroke patients.

Medical and hospitalisation fees are undoubtedly one of the largest expenses you may have to pay for. For instance, the But did you know that some things, such as certain drugs used in outpatient cancer treatment, aren’t covered by IP plans too?

Perhaps the pertinent question is, are you prepared for the other costs of critical illness that aren’t covered by your health insurance? Let’s take a look at what some of these costs are.

What are the hidden costs of critical illness?

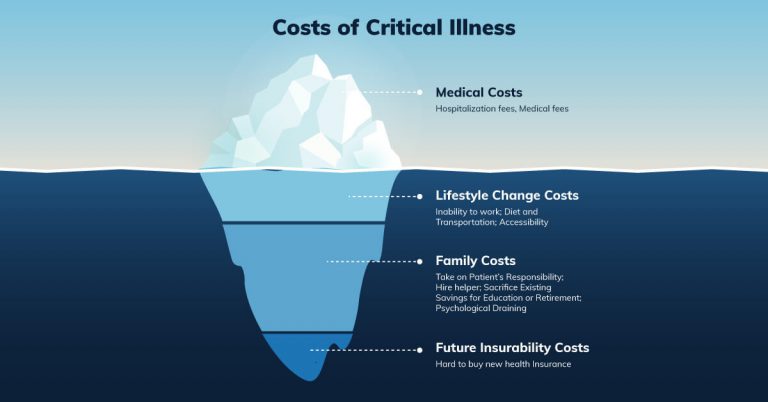

Just ask any critical illness patient and you’ll find that there’s more than meets the eye when it comes to managing their condition. Beyond upfront medical expenses, critical illness can impact your life in many different ways, and sometimes cost you more than money.

The hidden costs of critical illness can come in many forms, but here’s three that you should look out for: the cost of having to change your lifestyle, the cost of critical illness on your family, and its cost on your future.

1. Cost of having to change your lifestyle

A critical illness is a lifelong condition that often impacts your life beyond the first hospital visit. When you get sick, one of the biggest changes you’ll face is the inability to work.

More likely than not, most of your time will be spent on doctor visits, attending the likes of chemotherapy and physiotherapy, or simply recuperating at home. This makes it difficult for you to retain a full-time job.

Even if you feel well enough to work after some time, high-stress jobs are out of the question. Most patients who return to the workforce may opt for a lower stress job, which also comes with a lower salary. Inadvertently, this loss of income will place a dampener on your personal and family finances.

On top of that, you’ll have to make other changes to your lifestyle including diet and transportation. For cancer patients and heart attack survivors, nutrition is a key tenet of your recovery plan and you may have to dole out more for a healthier diet.

You may also not have the energy to for public transportation any more, and may have to opt for private-hire car services instead. For instance, stroke patients with mobility issues may opt for special transportation services that are wheelchair accessible, which cost more.

You may also have to make modifications to your home to better support your condition, such as installing hand rails and ramps to improve accessibility.

2. Cost of critical illness on your family

You may be the one who is sick, but most time, you won’t be bearing it alone. Your family and loved ones will be impacted, whether emotionally, financially or mentally, and they often have to make their own sacrifices.

Depending on your condition, they may have to take time off work or quit their jobs to become your caregiver. At the very least, they’ll have to take on your responsibilities and chores at home. These inevitably adds on to their workload and stress. To cope, they may have to engage a caregiver or helper, which adds on to the household expenses.

To pay for treatment and caregiving costs, you and your loved ones may also have to sacrifice existing savings that were initially meant for other things, such as retirement or your child’s tertiary education. You may also be forced into early retirement if you have lost your ability to work. After paying off your medical bills, do you have enough to retire early without having to worry about your family finances?

Then there’s psychological costs as well. It can be emotionally draining to accompany and care for a loved one through their diagnosis. It is also a period of change where huge adjustments have to be made, and sometimes therapy or counselling could help you and your family embrace these changes better.

3. Costs on your future

When you get a critical illness, you and your family’s future insurability may be affected. If you have not gotten any insurance for yourself, it’s too late to get the coverage you require now.

Ironically, this is also the time when you need the financial support from insurance the most. To avoid this situation, it’s important to get insurance early on when you are still healthy.

In some cases, your diagnosis may also affect your family’s ability to get the coverage they need, especially if the critical illness is linked to genetics. For this reason, it’s important to have a robust financial plan that can help support your family if things go awry.

Family planning is another side effect of critical illness that is less obvious. The toll on your body after repeated treatments for cancer such as chemotherapy and radiotherapy can affect your fertility, regardless of gender.

If you are planning to have a child in future, you may have to opt for fertility preservation methods such as egg freezing before you start your treatment. You may also have to rely on In-Vitro Fertilisation (IVF) treatment, which can cost as much as S$10,000 each cycle.

Protect yourself with critical illness insurance

The best way of combating a critical illness diagnosis is finding out how it potentially impacts your life – only then can you prepare for it.

As you can see, there are many hidden costs when you fall sick with a critical illness. While health insurance can help defray some of the upfront hospitalisation and medical costs, a good part of the expenses come later. This is where critical illness insurance can help.

For instance, Tiq’s 3 Plus Critical Illness covers you for the top three critical illnesses in Singapore – cancer, stroke or heart attack – and unlike health insurance, it gives you a lump sum payout upon diagnosis. The great thing about it is being able to use the money for what you need, even to pay for hidden costs, without any restrictions.

On top of that, Tiq’s 3 Plus Critical Illness gives you 100% of sum insured cash payout when you get diagnosed with cancer at all stages. This means that you take action early on when treatment is most effective, and increase your chances of recovery.

As a bonus, Tiq’s 3 Plus Critical Illness plan also provides complimentary death coverage of S$20,000 each for your children, for a maximum of four children.

You also won’t have to worry about losing your insurability as the Tiq 3 Plus Critical Illness plan is guaranteed yearly renewable up to age 85. All you have to do is get protected when you’re still healthy to enjoy lasting coverage in the future.

By planning ahead with 3 Plus Critical Illness, you and your family can focus on the important things instead of worrying about being unable to pay for what you need. Apply now to get instant coverage!

[End]

Information is accurate as at 17 June 2022. This content is for reference only. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.