About Tiq by Etiqa Insurance.

Making insurance as easy, clear and honest as possible is what Tiq is all about. Our convenient protection and insurance savings plans are specially designed to meet the needs of people in Singapore.

We’re the digital channel of Etiqa Insurance Singapore, an award-winning local insurer, which uses smart technologies to make insurance easy to buy, fast to claim.

Part of

Maybank Group

Rated 'A' Strong by

credit rating agency, Fitch

Policy Owner's

Protection Scheme

(PPF Scheme)

With a shared vision to transform insurance, Etiqa created the strong foundation for Tiq. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961.

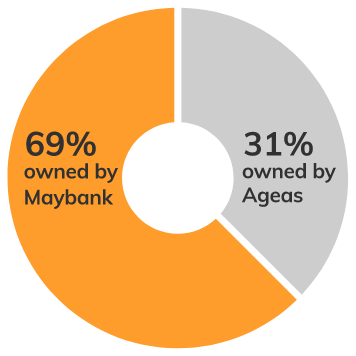

Strong financial backing from global shareholders

Maybank. Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries

Ageas. An international insurance group with 33 million customers across 16 countries

Here are some of our innovative products with first-in-market features

Cancer Insurance

with No Claim Discount

Online travel insurance

for transit travellers in Singapore

Home insurance with emergency cash allowance within 24 hours

Our Achievements

In the News

Etiqa Insurance Singapore Extends Support to Customers Impacted by Jetstar Asia’s Impending Closure

Etiqa Insurance offers goodwill travel cover to Jetstar Asia customers affected by flight cancellations, providing support for non-refundable expenses amid the airline’s closure.

Etiqa Insurance Singapore Returns as Official Travel Insurer at NATAS Travel Fair 2025

Etiqa Insurance Singapore is proud to return as the official travel insurer at NATAS Travel Fair 2025, offering comprehensive travel insurance plans to keep travellers protected and confident. Explore exclusive deals and trusted coverage designed for all your travel needs.

Maybank’s Insurance Arm, Etiqa Insurance, Pioneers the Return of Takaful Offerings in Singapore

Etiqa Insurance, Maybank’s insurance arm, reintroduces Takaful in Singapore—offering Shariah-compliant, ethical coverage to support financial inclusion.

Etiqa Insurance Singapore Extends Support to Customers Impacted by Jetstar Asia’s Impending Closure

Etiqa Insurance offers goodwill travel cover to Jetstar Asia customers affected by flight cancellations, providing support for non-refundable expenses amid the airline’s closure.

Etiqa Insurance Singapore Returns as Official Travel Insurer at NATAS Travel Fair 2025

Etiqa Insurance Singapore is proud to return as the official travel insurer at NATAS Travel Fair 2025, offering comprehensive travel insurance plans to keep travellers protected and confident. Explore exclusive deals and trusted coverage designed for all your travel needs.

Maybank’s Insurance Arm, Etiqa Insurance, Pioneers the Return of Takaful Offerings in Singapore

Etiqa Insurance, Maybank’s insurance arm, reintroduces Takaful in Singapore—offering Shariah-compliant, ethical coverage to support financial inclusion.

Be the first to know

Get the latest promotions and news

I consent and agree for Etiqa Insurance to collect, use and disclose the personal data above for the purposes of validation and sending, via telephone calls and text message. Read Etiqa's Privacy Policy [here]

Subscription Successfully.

Subscription Failed.