Tiq CashSaver

Start saving with what you have today, while protecting tomorrow’s dreams

What is Tiq CashSaver

Tiq CashSaver is a capital guaranteed endowment plan upon maturity. This plan provides a lump sum payout at maturity1 , guaranteed yearly cash benefits and non-guaranteed yearly cash benefit that provides you the flexibility to start saving from as low as S$125 a month2. The best part? Whether you’re saving for your child’s education, planning a vacation, or cultivating the habit of regular savings, you can begin today with an amount you’re comfortable with, knowing your savings are secure even if unexpected events occur.

Why choose Tiq CashSaver

Save Comfortably

We make taking that first step easy. Start saving from just S$125 a month2.

Yearly Cash Payout

Receive a steady flow of supplementary income3 from the end of your 2nd policy year, or you may accumulate your yearly cash benefit to further grow your savings at the prevailing interest rates4.

Secure Your Family’s Future

Place the plan under your child’s name while you remain insured against the unexpected. Future premiums will be waived should you become totally and permanently disabled5.

More incredible features of Tiq CashSaver

Flexible Savings Duration

Tailor your plan to fit your savings horizon from choosing to pay your premiums over 2 years, and save from 6 to 10 years; or pay your premiums over 5 years, and save from 11 to 15 years. You can even choose to pay your premiums monthly, quarterly, half-yearly or yearly. That’s flexibility!

100% Capital Guaranteed

Your savings are safe. Upon maturity of your policy, you’re guaranteed to get 100% of your capital back, providing you with a stable foundation for your future.

Hassle-free Guaranteed Acceptance6

Enjoy a hassle-free application online with no medical examinations required.

More incredible features of Tiq CashSaver

Flexible Savings Duration

Tailor your plan to fit your savings horizon from choosing to pay your premiums over 2 years, and save from 6 to 10 years; or pay your premiums over 5 years, and save from 11 to 15 years. You can even choose to pay your premiums monthly, quarterly, half-yearly or yearly. That’s flexibility!

100% Capital Guaranteed

Your savings are safe. Upon maturity of your policy, you’re guaranteed to get 100% of your capital back, providing you with a stable foundation for your future.

Hassle-free Guaranteed Acceptance6

Enjoy a hassle-free application online with no medical examinations required.

The savings plan that’s with You through difficult times

Protection for Death and Terminal Illness

We pay 101% of the total premiums paid in the event of Death or Terminal illness7 of the life insured. In the event of accidental death of the life insured8, we pay an additional 50% of the total premiums paid in addition to the Death Benefit.

Keeping Your Savings On Track for the Future

Saving for your loved one’s future? If you become totally and permanently disabled during the premium term, we will waive your remaining premiums5. Your savings stay on track even as life throws you a curveball.

Extended Grace Period for Difficult Times

Worried about retrenchment or hospitalisation affecting your savings plan payments? You can request for a 60 day extension to your policy’s grace period in difficult times9.

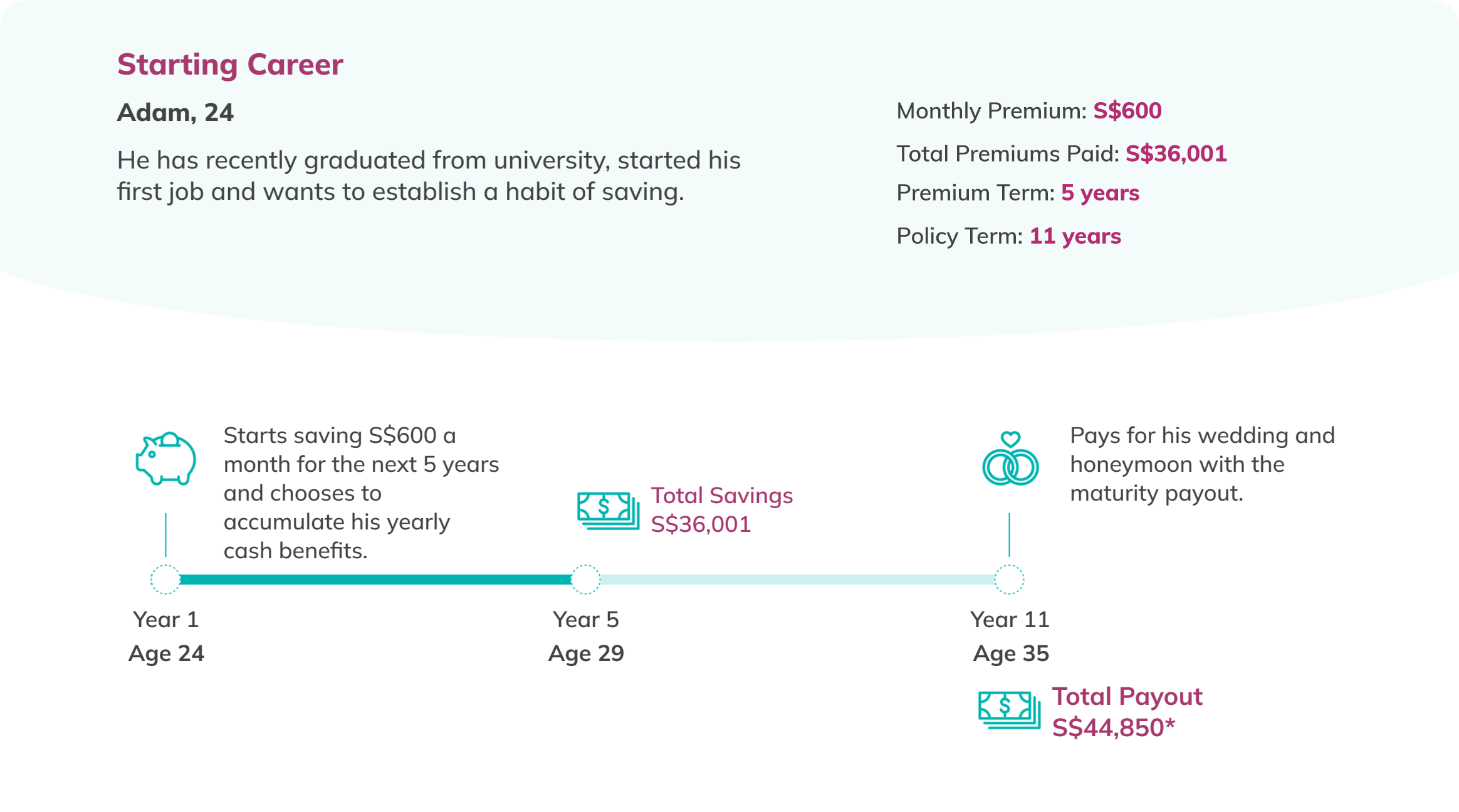

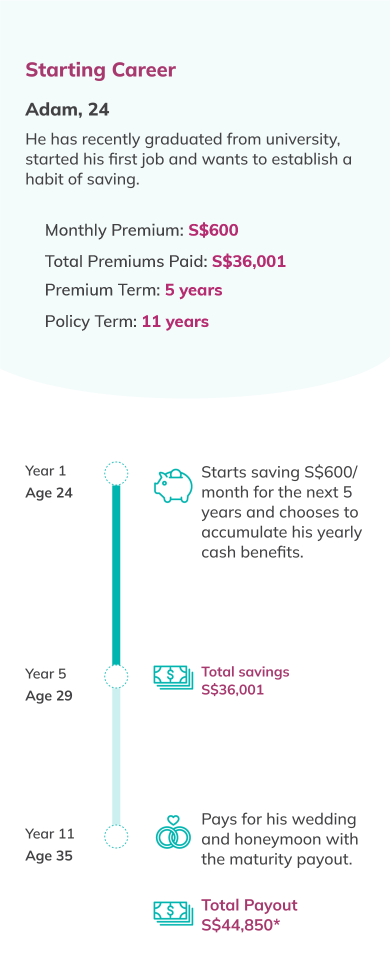

How it Works

*The illustrated values use bonus rates assuming an illustrated investment rate of return of 4.25% p.a. As bonus rates are not guaranteed, the actual benefits payable will vary according to the future performance of the participating fund. At 3% p.a. illustrated investment rate of return, the Policy Maturity Benefit is S$40,716.

Important note: All values are rounded to the nearest dollar for illustrative purposes only.

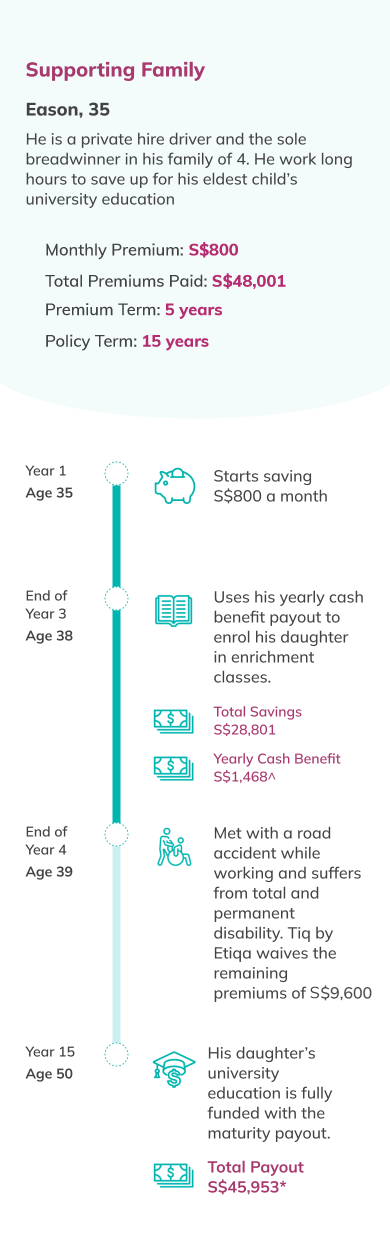

^ The illustrated yearly cash benefit payout amount consists of a guaranteed amount of S$894 and a non-guaranteed amount of S$573 assuming an illustrated investment rate of return of 4.25% p.a. At 3% p.a. illustrated investment rate of return, the non-guaranteed amount is S$314.

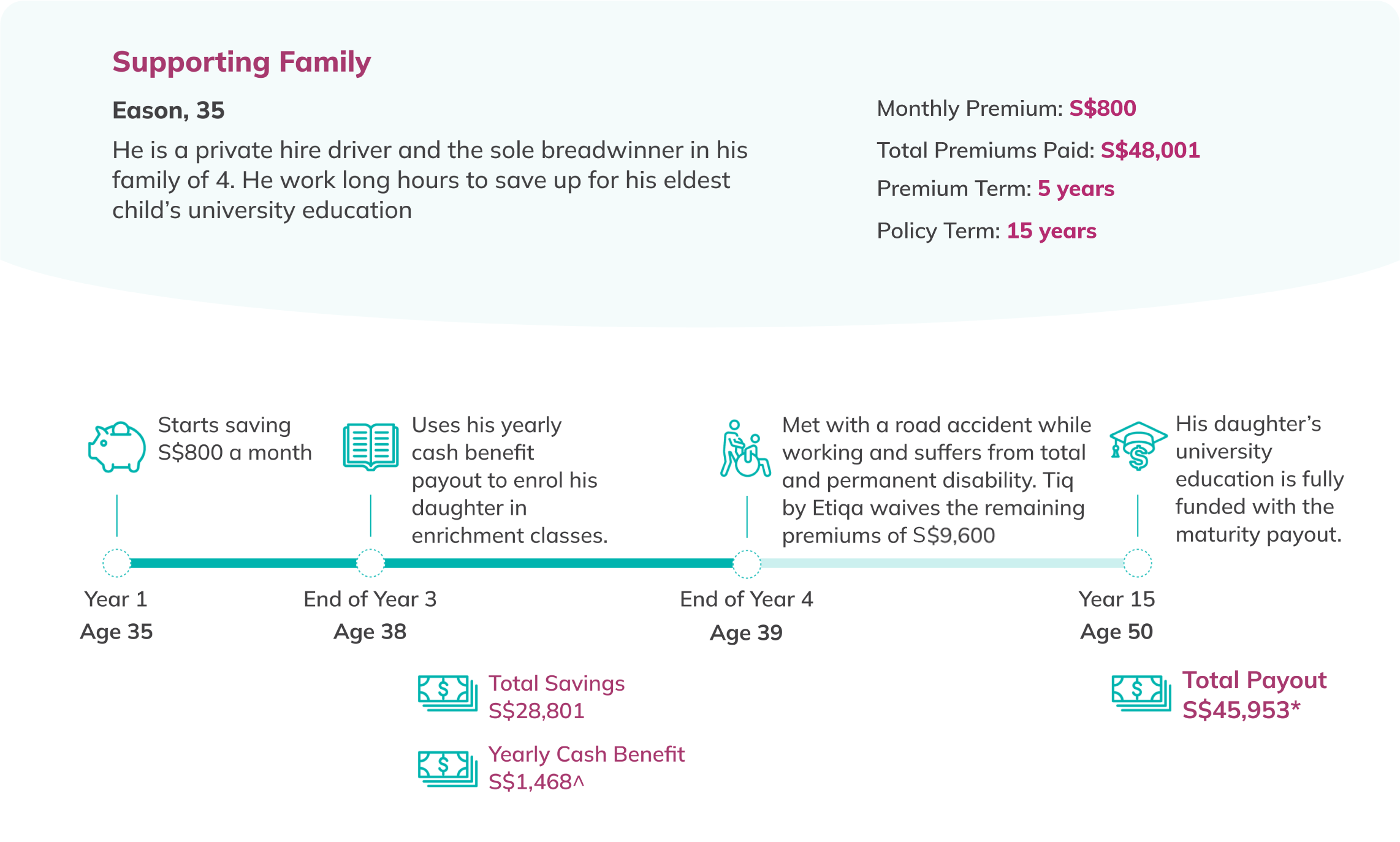

*The illustrated values use bonus rates assuming an illustrated investment rate of return of 4.25% p.a. As bonus rates are not guaranteed, the actual benefits payable will vary according to the future performance of the participating fund. At 3% p.a. illustrated investment rate of return, the Policy Maturity Benefit is S$42,766. It includes the last Yearly Cash Benefit and Non-Guaranteed Yearly Cash Benefit.

Important note: All values are rounded to the nearest dollar for illustrative purposes only.

^ The illustrated yearly cash benefit payout amount consists of a guaranteed amount of S$2,508 and a non-guaranteed amount of S$1,608 assuming an illustrated investment rate of return of 4.25% p.a. At 3% p.a. illustrated investment rate of return, the non-guaranteed amount is S$881.

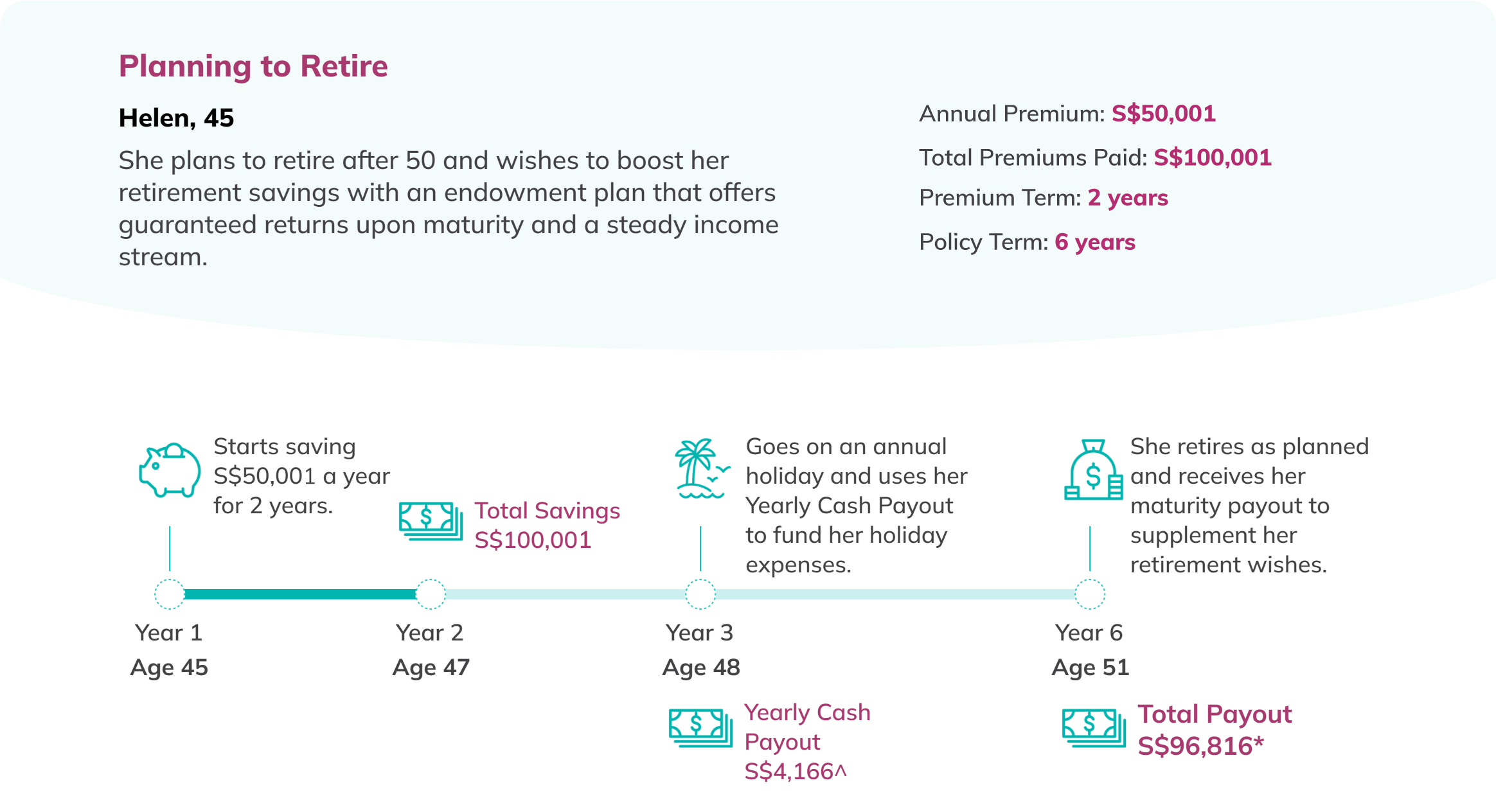

* The illustrated values use bonus rates assuming an illustrated investment rate of return of 4.25% p.a. As bonus rates are not guaranteed, the actual benefits payable will vary according to the future performance of the participating fund. At 3% p.a. illustrated investment rate of return, the Policy Maturity Benefit is S$93,780. It includes the last Yearly Cash Benefit and Non-Guaranteed Yearly Cash Benefit.

Important note: All values are rounded to the nearest dollar for illustrative purposes only.

*The illustrated values use bonus rates assuming an illustrated investment rate of return of 4.25% p.a. As bonus rates are not guaranteed, the actual benefits payable will vary according to the future performance of the participating fund. At 3% p.a. illustrated investment rate of return, the Policy Maturity Benefit is S$93,780. It includes the last Yearly Cash Benefit and Non-Guaranteed Yearly Cash Benefit.

^ The illustrated yearly cash benefit payout amount consists of a guaranteed amount of S$2,508.13 and a non-guaranteed amount of S$1,607.78 assuming an illustrated investment rate of return of 4.25% p.a. At 3% p.a. illustrated invest rate of return, the non-guaranteed amount is S$XX.

Important note: All values are rounded up to the nearest dollar for illustrative purposes only..

How it Works

*The illustrated values use bonus rates assuming an illustrated investment rate of return of 4.25% p.a. As bonus rates are not guaranteed, the actual benefits payable will vary according to the future performance of the participating fund. At 3% p.a. illustrated investment rate of return, the Policy Maturity Benefit is S$40,716.

Important note: All values are rounded to the nearest dollar for illustrative purposes only.

^ The illustrated yearly cash benefit payout amount consists of a guaranteed amount of S$894 and a non-guaranteed amount of S$573 assuming an illustrated investment rate of return of 4.25% p.a. At 3% p.a. illustrated investment rate of return, the non-guaranteed amount is S$314.

* The illustrated values use bonus rates assuming an illustrated investment rate of return of 4.25% p.a. As bonus rates are not guaranteed, the actual benefits payable will vary according to the future performance of the participating fund. At 3% p.a. illustrated investment rate of return, the Policy Maturity Benefit is S$42,766. It includes the last Yearly Cash Benefit and Non-Guaranteed Yearly Cash Benefit.

Important note: All values are rounded to the nearest dollar for illustrative purposes only.

^ The illustrated yearly cash benefit payout amount consists of a guaranteed amount of S$2,508 and a non-guaranteed amount of S$1,608 assuming an illustrated investment rate of return of 4.25% p.a. At 3% p.a. illustrated investment rate of return, the non-guaranteed amount is S$881.

* The illustrated values use bonus rates assuming an illustrated investment rate of return of 4.25% p.a. As bonus rates are not guaranteed, the actual benefits payable will vary according to the future performance of the participating fund. At 3% p.a. illustrated investment rate of return, the Policy Maturity Benefit is S$93,780. It includes the last Yearly Cash Benefit and Non-Guaranteed Yearly Cash Benefit.

Important note: All values are rounded to the nearest dollar for illustrative purposes only.

How it Works

*The illustrated values use bonus rates assuming an illustrated investment rate of return of 4.25% p.a. As bonus rates are not guaranteed, the actual benefits payable will vary according to the future performance of the participating fund. At 3% p.a. illustrated investment rate of return, the Policy Maturity Benefit is S$40,716.

Important note: All values are rounded up to the nearest dollar for illustrative purposes only.

Useful Information

Product Summaries

Product Brochure:

Policy Contract

Promotion Terms & Conditions:

Helpful Resources

Frequently Asked Questions

- You can purchase this policy for yourself if you are:

- a Singapore citizen or permanent resident with a valid NRIC; or

- a foreigner holding a valid Work Pass/Permit or Long-Term Visit Pass; and

- between age 17 to 65 (age next birthday);

- residing in Singapore.

- You can also purchase this policy for your child if he/she is:

- a Singapore citizen or permanent resident with a valid NRIC or Birth Certificate; or

- a foreigner holding a valid Long-Term Visit Pass; and

- your child is between age 1 to 16 (age next birthday);

- residing in Singapore.

- Grow your wealth

- Upon maturity if the policy is still in force, the maturity benefit payable is the sum of the following: a) the guaranteed maturity value; and b) performance bonus (if any); and c) yearly cash benefit and non-guaranteed yearly cash benefit accumulated with us (if any); less any amount owing to us.

Calculate your potential maturity value based on your savings goals here

- Upon maturity if the policy is still in force, the maturity benefit payable is the sum of the following: a) the guaranteed maturity value; and b) performance bonus (if any); and c) yearly cash benefit and non-guaranteed yearly cash benefit accumulated with us (if any); less any amount owing to us.

- Enjoy yearly cash benefits

- You will receive a guaranteed and non-guaranteed yearly cash benefit starting from the end of the second policy year until the policy matures. Please refer to the yearly cash benefit section for more details on your guaranteed yearly cash benefit.

- Life cover

- Death benefit in the event of death of the life insured during the policy term, the death benefit payable is the sum of the following: a) 101% of the total premiums paid (excluding Advance Premium); and b) performance bonus (if any); and c) yearly cash benefit and non-guaranteed yearly cash benefit accumulated with us (if any); less any amounts owing to us. When we make this payment, the policy ends.

- Terminal Illness (TI) benefit

If you, the life insured are diagnosed with a TI while the policy is in force, we will pay you the death benefit in one lump sum. The maximum aggregate amount payable is five million Singapore dollars (SGD 5,000,000) per life insured for all policies and riders issued by us with TI benefit. When we make this payment, the policy ends. - Accidental death benefit

Upon accidental death of the life insured on or before reaching the policy anniversary when the life insured attains age 80 while the policy is in force, we will pay 50% of the total premiums paid (excluding advance premium) in addition to the death benefit. When we make this payment, the policy ends.

- Total and permanent disability premium waiver benefit

- If you, the policy owner become totally and permanently disabled (on or before reaching the policy anniversary when you attain age 86) during the premium term while the policy is in force, we will waive all future premiums on the policy for the remaining premium term.

- Proof of Retrenchment and Unemployment

- A formal retrenchment letter from your previous employer.

- Proof of unemployment, which could be in the form of unemployment benefits application, records showing no income from employment, or a statutory declaration that you have not been employed.

- Any additional documents requested by the insurance company to show that you have been unemployed for at least 30 consecutive days before reaching age 65.

- Proof of Hospitalisation Leave for Self-Employed

- An official hospitalisation leave certificate or document issued by a Singapore Hospital.

- Medical records or a doctor’s statement verifying that you have been hospitalised or were required to be on medical leave for 60 days or more.

- If you’re self-employed, you may also need to provide proof of your self-employed status, which could include business registration documents, tax returns, or other official documents that show you are operating your own business.

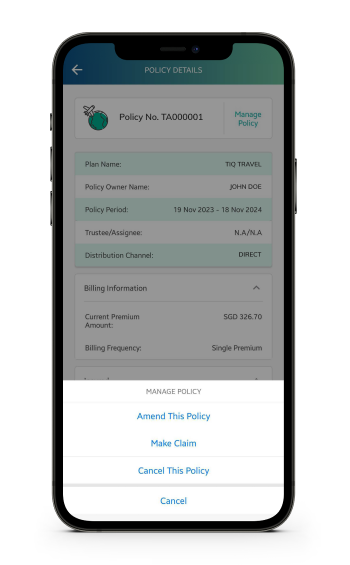

Managing Your Savings Plan Just Got Easier

Skip lengthy phone calls or emails and manage your Tiq CashSaver policy with the Tiq by Etiqa app.

2. Manage your plan anytime, anywhere

Login to your account and switch between reinvesting or withdrawing your yearly cash benefit, arrange for recurring payments, pause or cancel your policy

3. Sit back and relax

Your changes are confirmed and that’s all you need to do!

Managing Your Savings Plan Just Got Easier

2. Manage your plan anytime, anywhere

Login to your account and switch between reinvesting or withdrawing your yearly cash benefit, arrange for recurring payments, pause or cancel your policy

3. Sit back and relax

Your changes are confirmed and that’s all you need to do!

Tiq CashSaver

Receive S$50 Tiq Travel Insurance voucher with every purchase.

Terms apply. Protected up to specified limits by SDIC.

See What Our Customers Say

Featured Articles

How Much Should You Risk on Investment?

Goal Based Investing: Investments Made Easier

Are You Making These Common Investment Mistakes?

1Upon maturity if the policy is still in force, the maturity benefit payable is the sum of the following: a) the guaranteed maturity value; and b) performance bonus (if any); and c) yearly cash benefit and non-guaranteed yearly cash benefit accumulated with us (if any); less any amount owing to us.

All bonuses are not guaranteed. This is a participating plan and actual amounts may vary depending on the performance of the participating fund that the plan is invested.

2Based on a premium term of 5 years and yearly payment of S$1,500 (rounded to the nearest dollar).

3 Receive a guaranteed yearly cash benefit starting from the end of the second policy year until the policy matures, as long as the life insured is alive and the policy is in force. The guaranteed yearly cash benefit is 3.9% p.a. of the face value, while the non-guaranteed yearly cash benefit is 2.5% p.a. of the face value based on the illustrated investment rate of return of 4.25% p.a. In comparison, at an illustrated investment rate of return of 3% p.a, the non-guaranteed yearly cash benefit expected to be adjusted downwards depending on the future outlook of the Participating Fund. Please refer to the policy illustration for the non-guaranteed yearly cash benefit amount at the investment rate of return of 3% p.a and 4.25% p.a respectively. The two rates are used purely for illustrative purposes and do not represent upper and lower limits of the investment performance of the Participating Fund.

4The guaranteed and non-guaranteed yearly cash benefits accumulated with us will be at the prevailing interest rate. The prevailing interest rate is non-guaranteed and we may change the interest rate at any time by giving you thirty (30) days’ written notice.

5The Total & Permanent Disability (TPD) Premium Waiver Benefit waives all future premiums on the policy for the remaining premium term if you become totally and permanently disabled (on or before reaching the policy anniversary when you attain age 86) during the premium term while the policy is in force.

6Provided you are eligible to apply for Tiq CashSaver and make a simple declaration.

7The Death Benefit payable will be: (a) 101% of the total premiums paid (excluding Advance Premium); (b) performance bonus, if any; and (c) yearly cash benefit and non-guaranteed yearly cash benefit accumulated with us (if any); less any amounts owing to us. If the life insured has a Terminal Illness while the policy is in force, the Death Benefit is paid in one lump sum. The maximum aggregate amount payable is S$5,000,000 per life insured for all policies and riders issued by us with Terminal illness benefit. If Advance Premium is paid and death occurs in the first year, the Advance Premium will be refunded with no interest.

8The Accidental Death Benefit payable is 50% of the total premiums paid in addition to the death benefit. It covers the life insured on or before reaching the policy anniversary when he attains age 80.

9The Extended Grace Period Option benefit can be exercised two (2) times if you meet with the following events: (a) You are retrenched and remained unemployed for at least thirty (30) consecutive days before reaching age 65; or (b) if you are self-employed and are issued a hospitalisation leave for sixty (60) days or more by a Singapore hospital. Please refer to the policy contract for the full terms and condition.

Age means the age at next birthday.

This policy is underwritten by Etiqa Insurance Pte. Ltd. This content is for reference only and is not a contract of insurance. Full details of policy terms and conditions can be found in the policy contract. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advise from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information accurate as at 23 May 2024.