Are you procrastinating on investing due to a fear of the unknown that may lead to potential losses? Well, knowledge is the key to unlocking all doors. If you have been thinking of investing but have yet to do so, you can start with learning these common investment mistakes.

Here’s your investing cheat sheet to avoid the common pitfalls – courtesy of Tiq Invest Investment-Linked Plan (ILP). You’re welcome!

1. Procrastination

We often heard investors lamenting on how they wished they had started investing earlier. That’s because one can benefit from long term growth trends and compound interest with the right investment product.

In case you are experiencing a bout of the ostrich effect, trusting that everything will go well if you don’t take action, just like how ostriches hide their heads in the sand to ignore danger or pretend it doesn’t exist to protect themselves… note that your procrastination towards investing will affect your financial well-being in time to come.

Investing early means that you have a longer period of time to mitigate timing risk, often through dollar-cost averaging (read this to learn more about this investment strategy), as well as a higher chance of achieving your financial goals earlier. Also, practice makes perfect. So, why wait?

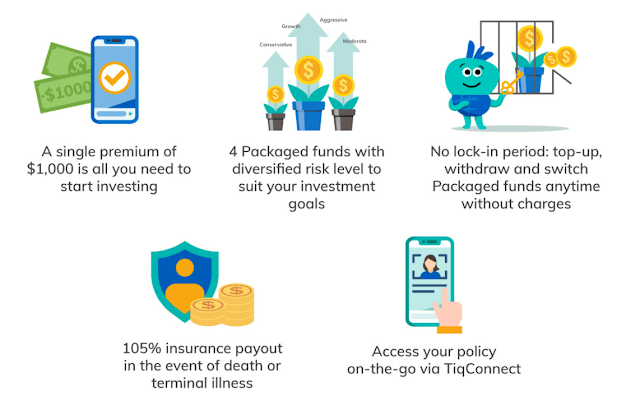

Pro-tip: Get started with Tiq Invest – a digital ILP that combines life protection and wealth accumulation – for maximum financial flexibility. Learn more.

2. Unclear investment objectives

Many people jump on the bandwagon of investing merely because our friends are doing so. If you are guilty of this too, you would soon realise that investing doesn’t work this way. Just like insurance, investing is a personal journey and you need to know clearly where you want to go, what you want to achieve, etc. to avoid disappointments and regrets.

Are you investing to beat inflation, accumulate greater wealth for a certain goal (i.e. fund your child’s education) or investing for retirement planning? Your investment objectives are akin to an investment blueprint that will help you and your fund managers to determine the best way forward. Think goal based investing.

For example, if your main investment goal is to fund your child’s education, you would most likely adopt a more aggressive investment strategy as compared to if your goal is to save for retirement.

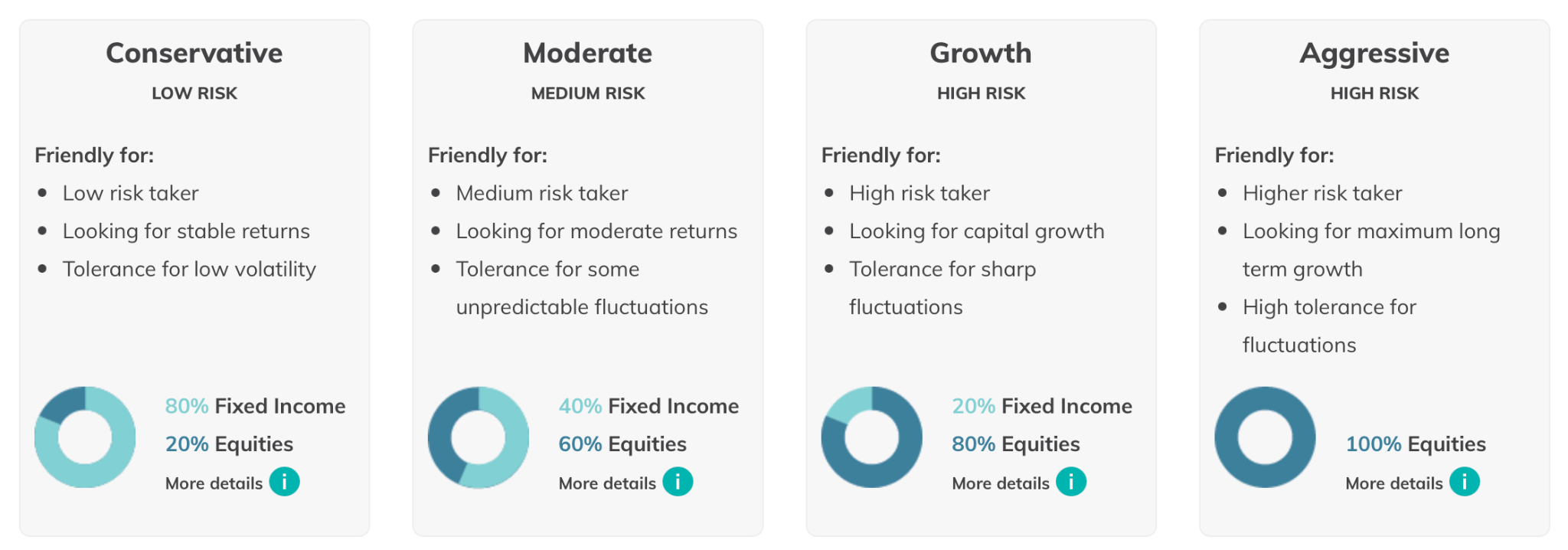

Tiq Invest makes investing easier by offering the above four specially curated Packaged Funds (a mixture of fixed income funds and equities) to match your risk level while maximising returns. The best part? It is managed by reputable local expertise and global funds managers like Dimensional Fund Advisors, PIMCO Global Advisors (Ireland), BlackRock Global Funds and Lion Global Investors.

3. Chasing the trends

Chasing the trends is a common investment mistake that’s very risky. What works for someone else may not necessarily work for you but when it comes to word-or-mouth and lucrative returns, it can be easy to get FOMO (fear of missing out). Such is the case of cryptocurrency trading in Singapore and around the world.

However, it is important not to expect too much or use someone else’s expectations. Instead of investing because of a hype or a friend’s endorsement, you can mitigate some risks by doing your due diligence.

Another option would be to invest passively in the markets through diversified funds such as those packaged by Tiq Invest, rather than to buy an individual company’s stock.

4. Timing the market

Market timing refers to the strategy of making buying or selling decisions of your financial assets by trying to predict future market price movements. “Buy low, sell high” may sound like the most logical thing to do but let’s not forget that nobody can predict the market. When stock plunges, we all have a natural impulse to sell but such emotional investing can increase the risk of incurring losses or lower your returns.

Taking reference from data that goes back to 1930, the Bank of America found that if an investor missed the S&P 500′s 10 best days each decade, the total return would stand at 28%. If, on the other hand, the investor held steady through the ups and downs, the return would have been 17,715%!

Seasoned investors often advise that time in the market (see point 1) is always wiser and more valuable than timing the market.

5. Trading too often

While it is recommended to review and rebalance your portfolio regularly, trading too much or too often implies higher risks and greater transaction fees that will affect your portfolio returns. Think of your investment journey as a marathon; if you keep changing your routes, you are expending unnecessary effort and time, and you are likely to reach your intended destination later.

To avoid trading too often, it is important to keep your investment goals in sight (see point 2). Adopting passive investing with a long term strategy plan can also help you to avoid trading unnecessarily.

F.Y.I. Tiq Invest carries out periodic rebalancing to ensure that your investment objectives are on track and tolerant to market outlook. However, if you really feel a need to reconfigure your investment portfolio, you should review your financial situation and learn more about the assets you hold before you make any changes.

6. Overlooking fees, taxes and commissions

New investors often overlook fees, taxes and commissions that may eat into your investment returns over the long term. In fact, you should be aware of the potential cost of each investment decision prior to opening an account. Some fees to look out for include advisory fees, fund management fees, fund switch fees, etc.

Unlike traditional ILP, the good thing about Tiq Invest digital ILP is our low and simplified charges. Our management charge fee1 at 0.75% per annum of your account value is one of the lowest in the market2. Also, there are no additional charges for fund switches, partial funds withdrawal or a full surrender. 100% of what you invest goes directly into the purchase of funds. Your dividends are also re-invested so you enjoy more growth!

7. Not diversifying enough

Spreading your money across and within different asset classes such as stocks, bonds and cash can sound intimidating, not to mention the hassle of keeping track.

That explains why investors often make the mistake of taking a large investment exposure in one security or sector to maximise their returns, but the results can be disastrous when the market shifts negatively.

On the other hand, adequate diversification can lower risk, smooth out returns and improve your portfolio performance in the long term. With a right investment tool such as Tiq Invest, diversification is part of the package. Wondering how you can better diversify your portfolio? Read this guide.

Invest simply but not blindly

With the FIRE (Financial Independence, Retire Early) wave gaining momentum over the past decade and especially after the COVID-19 pandemic, many people are starting retirement planning earlier and embarking on an investment journey to maintain their ideal lifestyle .

No matter where you are at your investment journey, bear in mind to do your due diligence and always make informed decisions. Here are some resources for your reference:

- Investment Strategies and Resources for Beginners

- The Ultimate Easy Investment Checklist

- Personal Finance Tips For Fresh Grads And First Jobbers

- Goal Based Investing: Investments Made Easier

Opt to invest simply, not blindly, with Tiq Invest digital ILP today!

[End]

1 A fee that we charge for the management of your Tiq Invest policy.

2 Based on the available digital Investment-Linked Plan (ILP) as at 12 July 2024. This comparison does not include information on all similar products. Etiqa Insurance Pte Ltd does not guarantee that all aspects of the products have been illustrated. You may wish to conduct your own comparison for products that are listed in www.comparefirst.sg.

Information is accurate as at 12 July 2024 . This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

Tiq Invest is an Investment-linked Plan (ILP), which invests in ILP sub-fund(s). Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s).

A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from us via www.tiq.com.sg/product/tiqinvest. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC web-sites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.