Having too much cash and having too much money are two different matters. You’d hardly hear anyone complaining of the latter, especially in Singapore where ‘money no enough’ is on to its third sequel. But we digressed.

When it comes to financial security, it’s comforting (and wise) to have an emergency fund aka cash reserve that you can tap on when you need it. Yet, cash is susceptible to inflation and stockpiling cash means that your hard earned money will lose its purchasing power over time, making you poorer just by having too much cash.

Why is it not good to have too much cash?

With Singapore’s core inflation rising to 4.8% as of July 2022, your excess cash – be it lying in the piggy bank, a safe or an ordinary savings account with interest rate lower than that of the inflation rate – is losing value. In other words, you are losing money.

To put things into perspective, a pack of 30 Pasar fresh eggs from NTUC Fairprice costs S$6.55 (at time of writing), as compared to S$4.75 last February. That’s about a 37% price increase over the span of just 1.5 years! If prices continue to increase (which is likely), that means you will have to cut back on eggs or work harder to earn more money.

The scary thing is, it’s not just about eggs.

Inflation applies to almost everything from groceries to electricity prices and loan rates. Even if you take on a second job to increase your earnings, your cash is still losing purchasing power. Seasoned investors would call this a portfolio drag, as holding the excess cash instead of investing would result in negative returns.

How much is too much cash?

Have you been max-ing out the S$75,000 insured deposit across several banks under the Deposit Insurance Scheme? If your answer is yes, you are likely holding too much cash.

As the saying goes, “don’t put all your eggs in a basket.” With all that talk about ‘longevity dividend’ in Singapore lately, you may want to start investing to make more out of your money. For the risk-adverse, there are some lower risk investments such as endowment plans that can preserve your capital or ensure guaranteed returns.

For example, Tiq 3-Year Endowment Plan offers high guaranteed returns of 2.90% p.a. with a short 3-year maturity period in its latest limited tranche – possibly the highest guaranteed maturity returns in town!* It also comes with life protection and Financial Assistance Benefit for the Novel Coronavirus (COVID-19). Learn more

So, how to better manage your cash and investments?

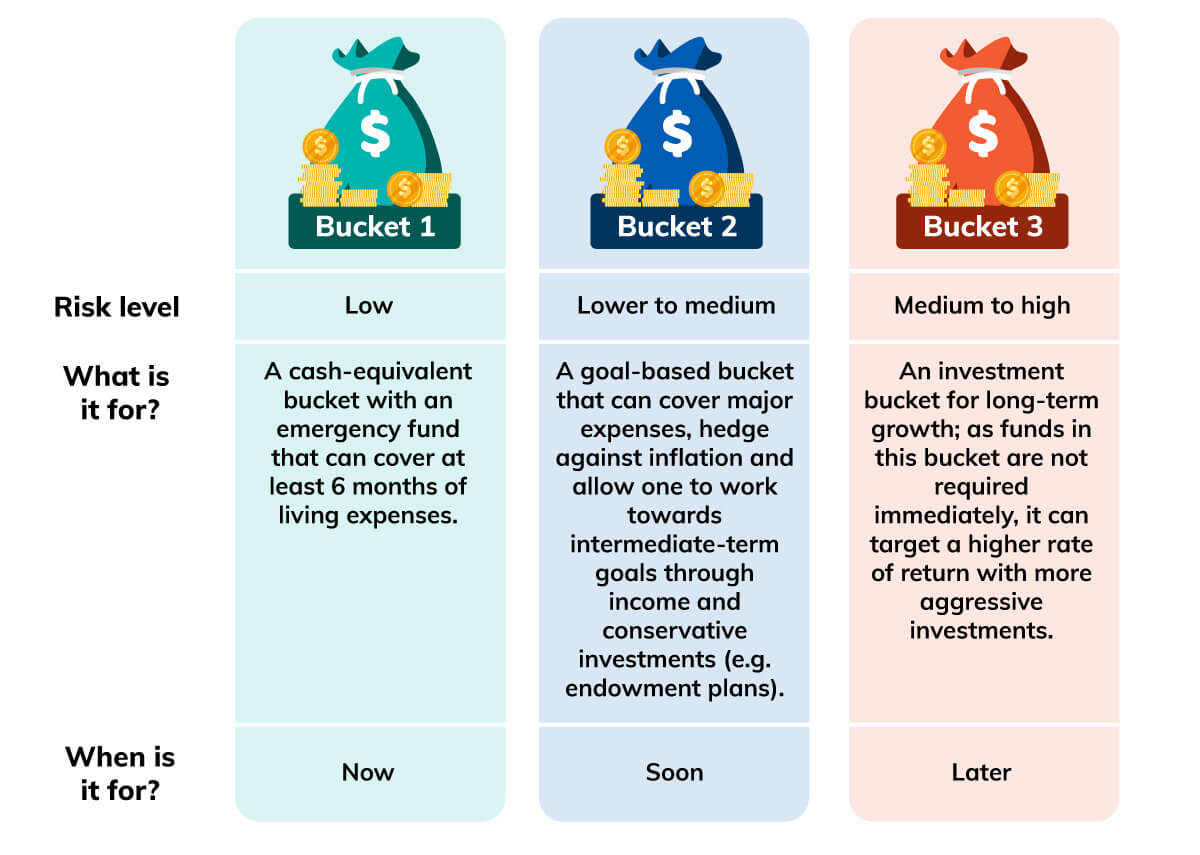

To begin, take stock of your current finances and identify what and how much you have. To find an optimal cash position, you can use the bucket approach to weigh short-term needs versus long-term goals as shown below.

Bucket 1 is a rather safe bucket with the main risk being inflation that threatens to erode your cash value over time. Hence, you should only be holding your emergency fund here, equivalent to at least 6 months of your daily expenses. If you are unsure of how to grow your emergency fund, you can compare notes with some of our customers who shared their experience on this topic.

Bucket 2 should be managed with major expenses and/or intermediate-term goals in mind. Perhaps you are saving towards a new car or down payment for a new home soon. Most people probably would not want to risk their money in the stock market for these big-ticket purchases.

Hence, you may consider funnelling some savings into purchasing securities, or even conservative short- or intermediate-term bond funds in this goal-based bucket.

Some endowment plans offer attractive guaranteed crediting rates and a short lock-in period too. However, as such plans are usually available for a limited tranche only, it helps to stay subscribed to your choice insurer.

Bucket 3 is an investment portfolio for your long-term goals. Delayed gratification is a fitting term as money in this bucket is meant for future use. By now, you know that having too much cash over a period of time is not a good thing, hence there should be little to zero cash holding in this bucket.

Depending on your financial situation and risk preference, this bucket can accommodate a higher risk level with more aggressive investments since funds in this bucket are not required immediately.

For those who are just embarking on the investment journey, you may want to check out Tiq Invest, a digital Investment-linked Plan (ILP) that combines life protection and wealth accumulation. It offers four specially curated Packaged Funds (a mixture of fixed income funds and equities) to match your risk level while maximising returns. Learn more

What to do with excess cash?

In the past, people often invested in property and gold when they had excess cash. Today, there are even more savings and investment choices for wealth accumulation.

To make the most out of your money, don’t miss this limited tranche of Tiq 3-Year Endowment Plan, now offering a high guaranteed 2.90% p.a. returns with a short 3-year maturity period.

If you are looking to diversify your portfolio with funds managed by Funds Managers like Dimensional Fund Advisors, PIMCO Global Advisors (Ireland), BlackRock Global Funds and Lion Global Investors, check out Tiq Invest here.

Last but not least, we understand holding excessively large cash deposits can feel safe in times of market volatility but that’s actually an irrational decision. After all, cash and liquidity are just one bucket in the wealth strategy and it pays to keep that in mind. 😉

[End]

Information is accurate as at 06 September 2022. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

*Compared to similar online single premium 3-year endowment plans available for subscription, as at 23 August 2022. This comparison does not include information on all similar products. Etiqa Insurance does not guarantee that all aspects of the products have been illustrated. You may wish to conduct your own comparison for products that are listed in www.comparefirst.sg.

Tiq Invest is an Investment-linked Plan (ILP), which invests in ILP sub-fund(s). Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s).

A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from us via www.tiq.com.sg/product/tiqinvest. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC web-sites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.