At Tiq, we’re always looking for ways to help you be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow. In our effort to do that, we have partnered with Autumn, a digital wealth, health and lifestyle solution.

Your golden years also have the potential to be your most vulnerable years. At this stage of your life, you would have given up your monthly pay-cheque but still need a way to to pay for daily expenses.

Relying on CPF LIFE for a part of your retirement expenses

This is where the benefit of all your regular contributions to CPF over the years kick in. You can lean on CPF LIFE, Singapore’s mandatory life annuity scheme, that will pay you a monthly income for as long as you live. This is passive income that will last your lifetime – giving you peace of mind.

However, this monthly payout alone may not be enough for your entire monthly expenses in retirement.

According to the latest Singapore Household Expenditure Survey 2017/18, CPF LIFE (and its predecessor the Retirement Sum Scheme) contributes to just $361 a month to the average retiree household. Meanwhile the report also states that retiree households are spending $1,967 on average.

The difference has to come from somewhere.

Of course, one way for you to offset the difference is to contribute more to your CPF accounts via the Retirement Sum Topping Up (RSTU) Scheme. This will give you a higher CPF LIFE monthly payout when you retire.

Going beyond CPF LIFE

Something else you can think about is to build a retirement portfolio that can fund your retirement without touching your principal. This way, you continue to receive retirement stability and ensure that you never run the risk of outliving your money.

There are also other benefits such as preserving your wealth to leave behind for future generations, and gaining financial flexibility to retire at any point after building a portfolio that generates sufficient income for your daily expenses.

How much do you need each month?

The first variable to figure out is how much you need to spend each month. Each individual or couple may have unique expenses, but we can use statistics to understand what is needed on average.

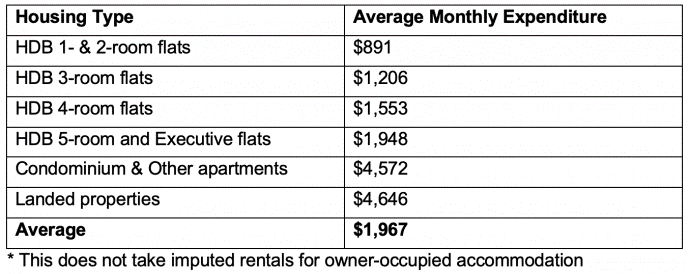

As a barometer for how much you may need, the Singapore Household Expenditure Survey 2017/18 also provides details on how much retiree households spend based on their housing type.

By understanding how much you may spend each month, you will have a better sense of how big your portfolio needs to be.

How much do you need in your portfolio?

Based on the average household expenses in Singapore, a retiree household will need $23,604 a year ($1,967 x 12 months). Remember, based on your expenses, you may need more or less.

To figure out how big your retirement portfolio needs to be, you need to estimate your portfolio returns.

While the S&P 500 has historically been able to deliver about 6% returns each year on average, you need to take a more conservative approach to generating income in your retirement – as you cannot afford big dips and years when returns are insufficient to cover your daily expenses.

More conservatively, an annual return of 3% may be closer to what you can achieve without taking excessive risks. This means your portfolio value needs to be $786,800 to provide you an income of $23,604 each year.

What can you invest in?

To receive an income from your investments in retirement, you need to focus on investing in financial products that generate income. Some potential investments include rental properties, high-dividend stocks, REITs and bonds.

For example, if you invest in the S&P 500 index, you may be taking on excessive risks as there are periods when it dips drastically. The second risk is also that the S&P 500 stocks typically pay an annual dividend of 1.5% – this means you may need to actively manage buying and selling part of your portfolio to fund your retirement.

What you invest in should also be a function of your financial knowledge. If you are well-versed in investments, you can manage your portfolio more actively even in retirement. However, for those who are not financially-savvy, a less risky retirement portfolio may be the best solution to pay for your daily expenses. You can then invest spare funds to gain higher upsides in your investment.

Steps to take even before building your income-replacement portfolio

There are several steps you can take to improve your chances of building a retirement portfolio that can pay for your daily expenses.

- Reduce your month expenses. With a simpler lifestyle and lower monthly out-of-pocket, your portfolio does not have to be so large and/or does not have to be able to produce high returns. This makes it easier to build the portfolio and also means you do not have to take excessive risks today in order to achieve that return.

- Make use of CPF LIFE. After contributing to your CPF accounts throughout your working years, CPF LIFE payouts then provide you a monthly income for as long as you live. This reduces the need for your portfolio to generate a prohibitively large return.

- Brush up on your financial and investing knowledge. The truth about being prepared for your golden years is you have to invest. With better knowledge, you don’t only invest better, but more importantly, you do not make rash or bad investments that may take a big dent in your investment portfolio.

This article is contributed by Autumn and first appeared here . All information is correct as at the date of publication on 4 March 2021. For more information, please visit Autumn.sg.

Build your confidence and take charge of your retirement planning with our easy and seamless digital insurance, investment, and life protection products.