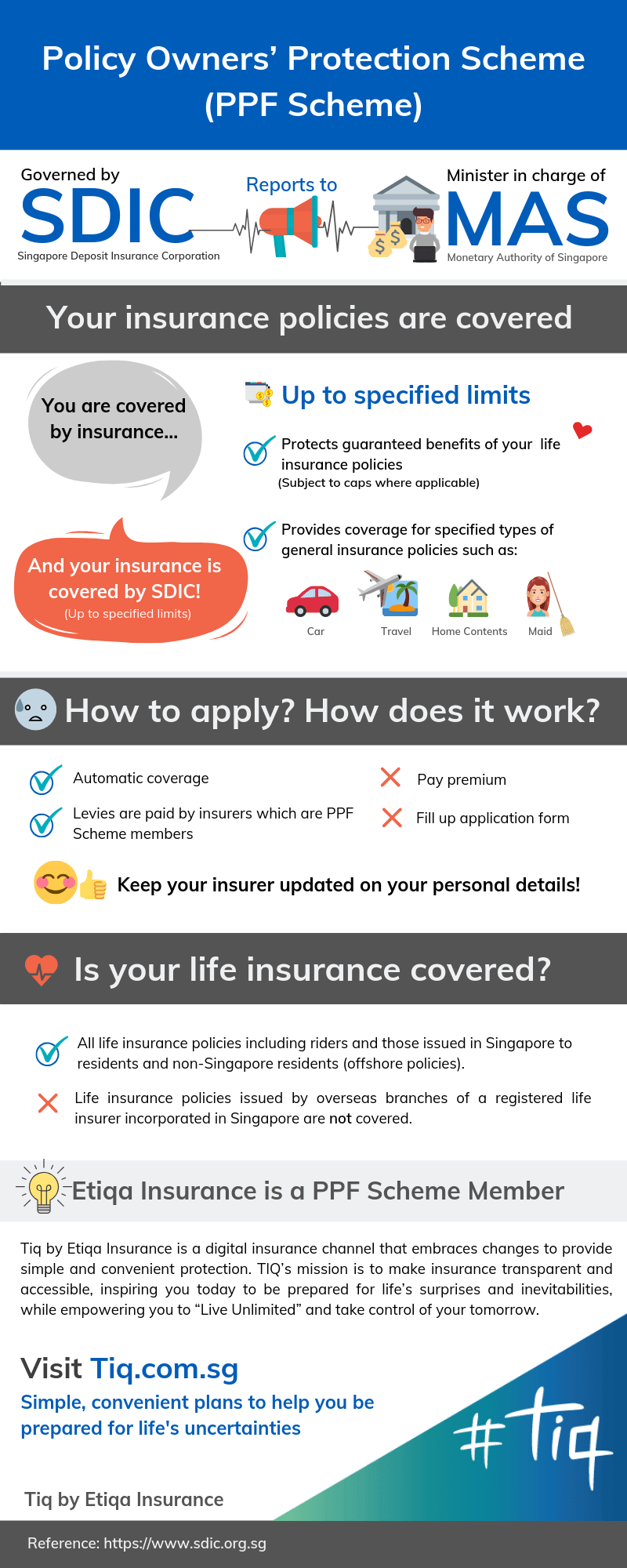

In Singapore, we are a pretty blessed bunch with certain rules and regulations implemented by the government to help us protect our monies and investments to a certain extent. If you are considering to purchase life insurance or any insurance in general, you should be aware of the Policy Owners’ Protection Scheme (PPF Scheme), which is administered by the Singapore Deposit Insurance Corporation (SDIC). Check out our infographic to understand better in layman’s terms.

1. About the company that protects you as a policy owner

SDIC is a company limited by guarantee under the Companies Act, and set up to protect policy owners in case (touch wood!) a life or general insurer that’s a PPF Scheme member is unable to sustain their business.

SDIC is accountable to the Minister in charge of the Monetary Authority of Singapore (MAS).

2. What is PPF Scheme?

This is a scheme that protects policy owners in the event a life or general insurer, which is a PPF Scheme member, fails. The PPF Scheme protects:

• Guaranteed benefits of life insurance policies such as ePROTECT term life. This is subject to caps where applicable.

• Coverage for specified types of general insurance policies (Please refer to point 4)

3. Are all types of life insurance policies covered under the PPF Scheme?

All life insurance policies including riders and issued in Singapore to both residents and non-Singapore residents (offshore policies) are covered. For more information, please read this.

However, do note that life insurance policies issued by overseas branches of a registered life insurer incorporated in Singapore are not covered.

4. General insurance policies that are covered under the PPF Scheme include:

• All compulsory insurance policies under the Motor Vehicles (Third Party Risks and Compensation) Act and Work Injury Compensation Act and short- term accident and health (A&H) policies, issued by PPF Scheme members.

• Policies of specified personal lines where the risks arise in Singapore or the policy owner is resident in Singapore, issued to individuals by licensed PPF Scheme members such as:

- Personal motor insurance policies

- Personal travel insurance policies

- Personal property (structure and contents) insurance policies

- Foreign domestic maid insurance policies

5. How do you get covered under the PPF Scheme? Is there a fee?

Coverage is automatic as long as your insurer is a PPF Scheme member. There is no need to complete any application form or pay a premium. For your information, levies are paid by insurers that are PPF Scheme members.

Etiqa Insurance is a PPF Scheme member, and yes, we pay the levies.

Things to note before purchasing any insurance

Even though SDIC provides protection for certain insurance in case things go wrong, you should always evaluate your needs and seek advice from a professional financial advisor before making any insurance purchase.

For more information and the latest updates, please visit https://www.sdic.org.sg.

[End]

Information is accurate as at 10 July 2019. This content is for reference only. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). Protected up to specified limits by SDIC.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This advertisement has not been reviewed by the Monetary Authority of Singapore.

TIQ by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, TIQ’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for TIQ. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.