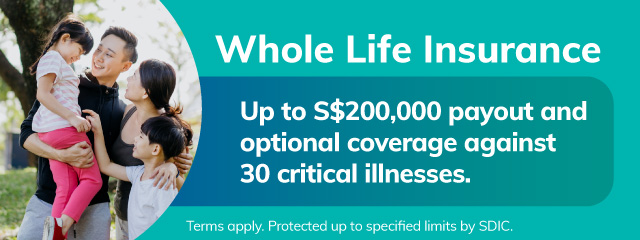

Whole Life Insurance

Affordable and reliable protection throughout your life.

A plan you can count on till old age

Some things in life are beyond our control. DIRECT – Etiqa whole life Insurance provides lifetime assurance that your loved ones will be financially secured if anything happens to you. Plus, the potential to grow the money you paid.

What We Offer

Lifetime protection for your loved ones during hard times

Get up to S$200,000 in the event of death, terminal illness and total and permanent disability. Your loved ones will not be left with debts or worries about living expenses. #touchwood

Whole life protection with a choice of premium term

Have the option to pay your premiums till age 70 or 85.

Your plan will continue to accumulate cash value and bonuses* while providing you with comprehensive protection throughout your life.

Greater savings on your premium

Your premium is secured from the time you sign up! Not to worry about increasing premiums as you get older. #startyourcoverageearly

Protection against 30 Critical Illnesses2

With our optional add-on cover, you and your loved ones can cope with the recovery cost if you suffer from a specific covered medical condition.

How DIRECT - Etiqa whole life protects you and your family.

This is

32 years old • Working couple • Expecting first child

“It’s good to have an affordable plan that provides both protection and cash value, so that I don’t have to burden my children when they grow up.”

Protected with DIRECT - Etiqa whole life

Lisa and Ben, both 32 years old and non-smokers, are expecting their first child in a few months. The working couple has existing mortgage and car loans. Lisa is considering getting Whole Life Insurance with a sum insured of S$200,000 that comprises cash value. She also buys DIRECT–Etiqa CI rider to include Critical Illness coverage of S$200,000.

This ensures that her family will get financial support when she passes on.

She also has the option to surrender the policy for cash value. She can then use cash value for to support her daily living expenses.

.

•

•

•

•

With DIRECT - Etiqa whole life

Her family will not be left with debt or worries about living expenses if she passes on.

Lisa can cope with the recovery cost if she suffers from a specific covered medical condition.

The payout can help her and her family adjusts to a new life or hire extra help if she becomes terminally ill or if an accident happens and causes her to become permanently disabled.

Lisa has the option to surrender her policy at age 72 and get S$196,091*. The lump sum of money can fund her daily living expenses.

*The above illustrated values use bonus rates assuming an investment rate of return of 4.25% per annum.

Affordable protection with great savings

From as low as

S$6.31 per day

Yearly Commitment

S$2,300 (+ S$954 with DIRECT–Etiqa CI rider add on)

Total premiums paid at age 72 is S$123,652

Total surrender value at age 72 is S$196,091*

(1.58 times of premium paid)

Based on S$200,000 whole life coverage (pay to 70-year old) for a 32 year-old non-smoking female.

*The above illustrated values use bonus rates assuming an investment rate of return of 4.25% per annum.

•

•

•

•

In the event of death or terminal illness

Nobody wishes for bad things to happen, but if Lisa becomes terminally ill when she is 40 years old, she will be able to receive up to S$200,000 in claims to help her and her family manage his medical and living expenses.

•

•

•

•

More complimentary cover, less stress. With Financial Assistance Benefits for COVID-19 and side effects of the vaccine, we hope this gives you better peace of mind. Read more here

Unsure of how much life insurance you need?

Simply answer a few questions on LIA life insurance calculator to better understand your financial protection needs.

The LIA Protection Gap Study3 shows that an average adult needs a life protection that’s 9 times of your annual income.

*The above illustrated values use bonus rates assuming an investment rate of return of 4.25% per annum. Assuming an illustrated investment rate of return of 3.00% per annum, the total surrender value at age 72 is S$123,888. The two rates 3.00% per annum and 4.25% per annum are used purely for illustrative purposes and do not represent the upper and lower limits on the investment performance of the participating fund. Bonuses are not guaranteed until they are declared to you.

1 Refer to FAQ below for more information

2Optional Add-on rider, available for DIRECT – Etiqa whole life plan

3Based on LIA recommendation for an economically active adult from the Protection Gap Study 2017

Don’t be shy, we’re here to help

Have an enquiry, not sure what’s best for your needs? Speak with us.

Get In Touch

Make an appointment for a callback or feel free to reach us at +65 6887 8777.

We’ll call you soon

Your appointment has been set. We'll call you at your preferred timing. Meanwhile, don't miss our latest deals!Have questions? We’re here to help

Planning for the future doesn’t have to be daunting. We are here to guide you through it.

Our operating hours are: Monday to Friday, 9.00am to 5.30pm (excluding public holidays)

Frequently Asked Questions

Yes, if you fulfil the following requirements:

• You are a Singapore resident with valid NRIC or FIN.

• You are between the age of 19 and 65 years old.

• You are a tax resident of Singapore.

• You have resided in Singapore for 182 consecutive days on day of insurance purchase.

• You are proficient in spoken or written English.

• You are not an undischarged bankrupt.

• You are not purchasing this plan to replace any existing policy with Etiqa or other insurer(s).

You can purchase online or through our Tiq by Etiqa app, available on Android and iOS.

Information You Might Find Useful

Featured Articles

Why Term Life Insurance is Not a Waste of Money

An Easy Guide To Personal Income Tax Rebate

Essential Life Cover

Looking for lifetime protection with flexibility? Choose Essential Life Cover for a boost of up to 400% of the basic sum insured.

See What Our Customers Say

Important notes:

This policy is underwritten by Etiqa Insurance Pte. Ltd. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg ). As term life insurance has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely. Information is correct as of 18 February 2025. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Be the first to know

Get the latest promotions and news

I consent and agree for Etiqa Insurance to collect, use and disclose the personal data above for the purposes of validation and sending, via telephone calls and text message. Read Etiqa's Privacy Policy [here]

Subscription Successfully.

Subscription Failed.