Check out GIGANTIQ, our all-in-one insurance savings tool before it’s gone too!

Thank you for your support!

Tiq 3-Year Endowment Plan is now fully subscribed. Leave your contacts and we’ll inform you when Tiq 3-Year Endowment Plan is available for signup.

Submit Successfully.

If you wish to sign up for Tiq 3-Year Endowment Plan, leave us your contact and we’ll be in touch soon!

You will be notified ahead of our upcoming tranche launch!

This product is based on a limited tranche, and first-come, first-served basis

Your hard-earned savings deserve high stable returns!

More complimentary cover, less stress. With Financial Assistance Benefits for COVID-19 and side effects of the vaccine, we hope this gives you better peace of mind. Read more here

Frequently Asked Questions

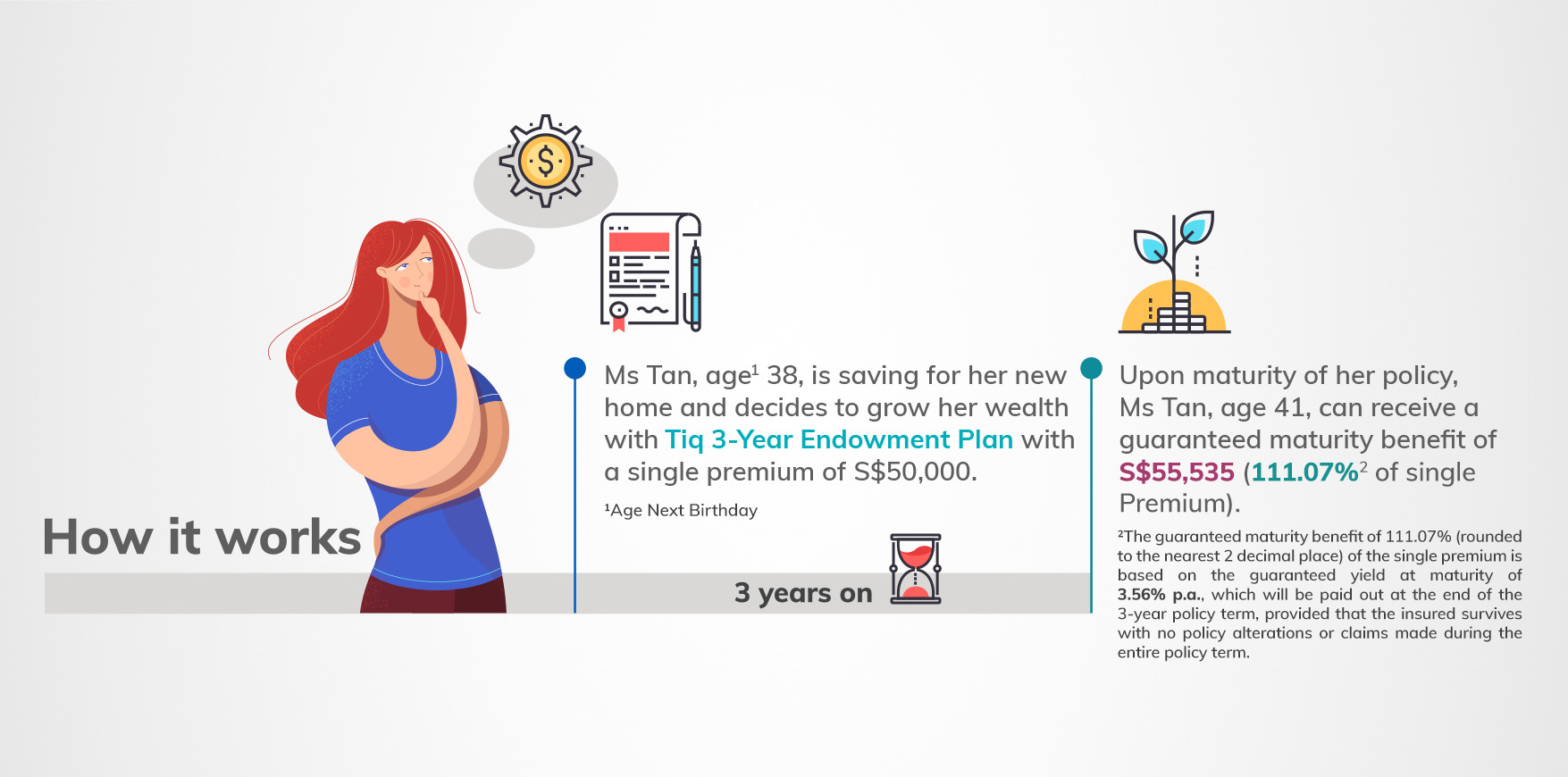

This is a single premium, non-participating life insurance savings plan. This plan has a policy term of 3 years. A lump sum guaranteed maturity benefit will be paid at the end of the policy term.

You can purchase this plan for yourself if you fulfill the following criteria:

a. You are a Singapore Resident with a valid NRIC or FIN; or

b. You are foreigner but you must be holding a valid Work Permit, Employment pass or Social pass.

c. You are between age 17 to 80 (age next birthday).

You are allowed to purchase multiple Tiq 3-Year Endowment Plan.

Our customer care team will be happy to take your questions during operating hours from Mondays to Fridays 8.45 am to 5.30 pm. Call us at +65 6887 8777 or start a live chat with us on our website. Alternatively, you may email us at customer.service@etiqa.com.sg and we will respond within two working days.

Before Applying

Verify via Myinfo or Snap photos of the front and back of your NRIC/FIN Pass

Submit your proof of address (from bills or statements) if you are non-Singaporean, or if your mailing address is different from your residential address

Pay via DBS/POSB bank account, PayNow QR or FAST transfer via PayLater

Information You Might Find Useful

Featured Articles

Li Chun 2023: We Help You Save Even More!

Too Much Cash Is Not A Good Thing

6 Ways Our Customers are Growing Their Emergency Fund

See What Our Customers Say

Important Notes:

This policy is underwritten by Etiqa Insurance Pte. Ltd. This content is for reference only and is not a contract of insurance. Full details of policy terms and conditions can be found in the policy contract. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advise from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Information accurate as at 9 November 2023. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Be the first to know

Get the latest promotions and news

I consent and agree for Etiqa Insurance to collect, use and disclose the personal data above for the purposes of validation and sending, via telephone calls and text message. Read Etiqa's Privacy Policy [here]

Subscription Successfully.

Subscription Failed.