If you’re a frequent flyer, you probably already know how important travel insurance is and that an annual multi-trip plan can offer better value than buying separate policies for each journey. But beyond just the upfront savings, have you ever considered the hidden benefits that come with it? From convenience to cost-effectiveness, there’s more to annual travel insurance than meets the eye. Before you choose between a single-trip or annual-trip policy, here are a few things to keep in mind to help you get the most out of your travel coverage.

Did you know? Singapore is the leader in international travel for leisure and business, with Singaporeans taking almost 7 international trips over two years? (Source: Visa)

Hidden savings of annual travel insurance

In Singapore, there are various travel insurers running different promotions, offering innovative travel promotions with different policies and terms. Everyone loves to get the best value out of their purchases, and it’s likely that you spend time researching for the most suitable travel insurance prior to each of your trip. The time and effort spent in researching are actually hidden costs, which you can save on if you purchase an annual travel insurance.

#TiqOurWord An annual travel insurance covers multiple individual trips to different destinations within a 12-month period—all with just a one-time purchase. That’s one of the hidden savings of annual travel insurance. After all, time is money, and with less hassle and admin work, you can focus more on planning your next adventure.

An annual plan may not be suitable for you if…

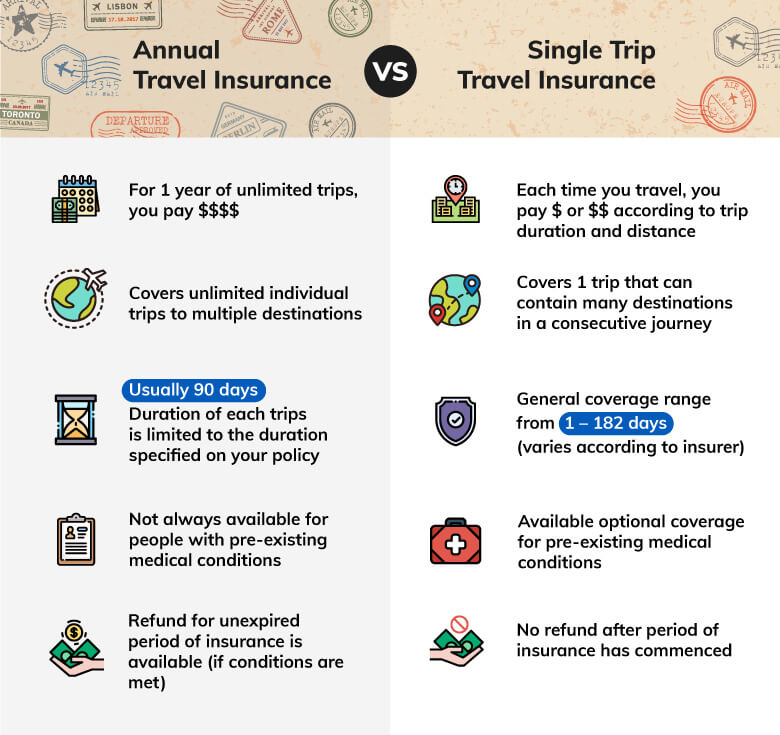

You’re not planning to travel much in a given year, or if you have pre-existing medical conditions. A single trip travel insurance plan may be a more suitable option for you.

Most travel insurers do not offer annual policies to those who declare that they have a pre-existing condition due to greater unforeseen risks. For such travellers, it would be prudent to ensure that you are adequately protected with an insurer that covers pre-existing medical conditions.

#TiqOurWord Tiq Travel Insurance by Etiqa is one of the few travel insurance plans in Singapore that offers optional coverage for pre-existing medical conditions. These may include common conditions like diabetes, asthma, sleep apnoea, and more. Find out more here.

You seldom hear this but…

If the travel insurance does not meet your needs, it is possible to request for a refund provided that the conditions (please refer to your policy terms) are met. While single trip travel insurance does not provide refund after your trip has commenced, annual travel insurance usually offers pro-rated refund for unexpired period of insurance.

Would annual travel insurance be worth the cost?

Singaporeans are pretty last-minute travellers. According to Criteo’s Asia-Pacific Digital Traveller Report, two in five Singaporean actually make their travel bookings four weeks or less before departure! However, the early bird catches the worm and if you are able to plan ahead for your travel, you will be able to get some great deals and have a better idea of whether an annual travel insurance is suitable for you.

Gentle reminder

When buying travel insurance, it’s important to review the types of benefits and coverage included in the plan. Be sure to check the claims limits, exclusions, and always read the fine print. Since each insurer offers different coverage options and policy terms, it’s essential to go through the policy document before making a decision.

[End]

Information is accurate as at 4 March 2019. This content is for reference only. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). Protected up to specified limits by SDIC.

This article was updated on 17 June 2025.

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.