Depositing money on Li Chun (立春), also known as Farmers’ Day, is believed to increase wealth and bring good luck. Are you hoarding cash in order to deposit it during the Chinese New Year holiday? The Year of the Rabbit holds great promise for those seeking to ‘HUAT’ (prosper)! Read on to learn about the best dates, timings, and ways to increase your savings in 2023!

What is Li Chun or Farmers’ Day?

Li Chun, which marks the beginning of spring and a new year, has traditionally been an important day for farmers in China, when they would pray for a good harvest. Due to Singapore’s shrinking agricultural sector, this tradition has evolved into depositing money into one’s bank account to symbolise abundant wealth for the new lunar year. If you notice long lines at ATMs across the island during the Chinese New Year period, that day is most likely Li Chun. Depositing money for good fortune during Li Chun is so popular in Singapore that banks have special measures in place to deal with the crowd. Are you ready to hop aboard the bandwagon?

#1 Plan ahead for Li Chun 2023

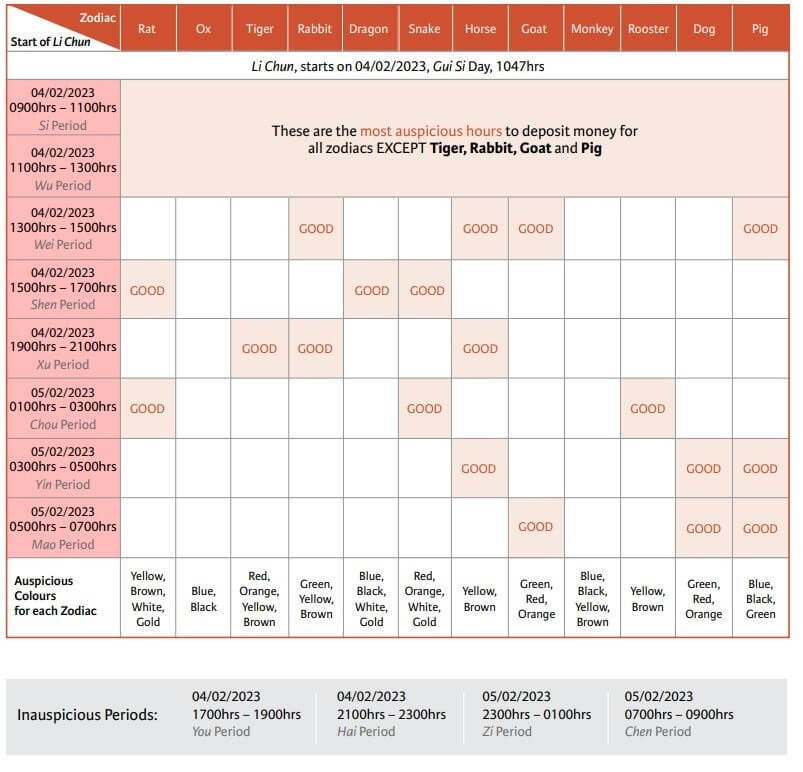

Li Chun falls on 4th February in 2023, and you can deposit money into your bank account based on the auspicious timeslot(s) that correspond(s) with your zodiac sign. Check out the following guide (courtesy of Way Fengshui) to determine the best time to deposit your money. At the same time, we should all be mindful not to blow our angbao money on unnecessary purchases.

#2 Save time = Save money

While we all would like to HUAT, bear in mind that time is money. Try to avoid the “popular” timeslots, or go the extra mile (literally) to use an ATM that is less frequented so you don’t waste time queuing. If you happen to get an e-angbao during Li Chun, consider yourself lucky!

#3 Get greater value out of your savings

From now till 28th February, enjoy up to 60% off and $500 cashback on our products! Earn 5x Etiqa Rewards Points and up to $18 additional angbao for purchases made via our Tiq app. Sounds pretty good, right? Well, terms apply so find out more here.

“HUAT” are you waiting for?

There’s a Chinese saying that goes, “The entire year’s work depends on a good start in spring”. We wish you a good head start in this New Year, and if you haven’t already done so, it’s time to consider how to make the most of your hard-earned money. Good luck!

[End]

Information is accurate as at 30 January 2023. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). Protected up to specified limits by SDIC. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you.

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.