You want to take control of your finances, but it feels overwhelming or you don’t know where to start. You may be seeking financial advisers to help with financial planning, but would like to take proactive steps to your saving, insurance, and investment needs. Enter the Basic Financial Planning Guide, which is filled with actionable small steps one can take to plug the gaps in your financial planning.

Basic Financial Planning Guide: What is It About?

The Basic Financial Planning Guide was developed by the Monetary Authority of Singapore (MAS) and MoneySense with:

- Central Provident Fund (CPF) Board

- Association of Banks in Singapore (ABS)

- Association of Financial Advisers (Singapore) (AFAS)

- Life Insurance Association (LIA)

Included in the guide are basic planning tips for 4 key needs, namely, Emergency Funds, Protection, Investments and Legacy Planning. Information is straight-forward and includes mention of how national schemes such as Central Provident Fund (CPF), MediShield Life, and CareShield Life can help in each of the 4 key needs. Check out the Basic Financial Planning Guide here.

What to Consider When Reviewing Your Financial Planning with the Guide

While the guide points you in the right direction, here are some additional things you can consider when planning your finances with help from the Basic Financial Planning Guide.

Create an Emergency Fund

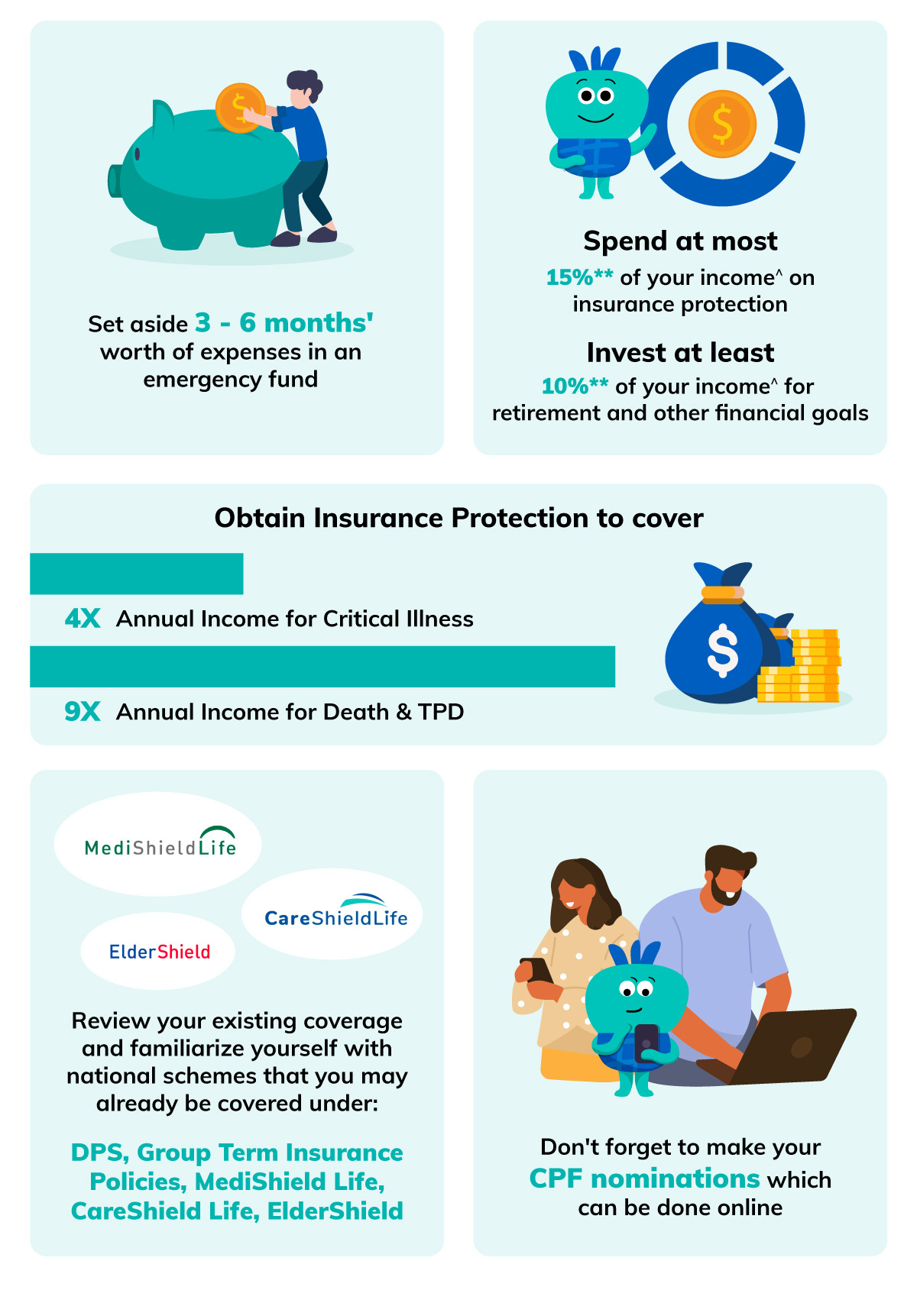

Set aside 3 – 6 Months’ worth of Expenses

- These are funds that should be easily accessible for use in case of emergencies. Some examples include:

- Loss of job

- Out-of-pocket expenses due to medical emergencies

- Unexpected home or car repairs

Keep your savings in a combination of savings accounts, Singapore Savings Bonds (SSB), which allows you to convert into cash in times of need quickly.

Considerations

If you’re a gig worker, freelancer, or business owner with an irregular income, you might want to consider a higher amount of emergency funds. You can consider speaking to a qualified financial advisor on your specific situation and financial needs.

Obtain Insurance Protection

Coverage of 9x your annual income for Death and Total Permanent Disability and 4x your annual income for Critical Illness

- You might want to check if you’ve spent at most 15%** of your income^ on insurance protection

- You can review your coverage and adjust your coverage if your annual income has changed over the year to strengthen your financial safety net

- While reviewing your coverage and considering how to enhance it, familiarize yourself with national schemes that you may already be covered under:

- Dependents’ Protection Scheme (DPS)

- Group Term Insurance Policies (e.g. MINDEF & MHA Group)

- MediShield Life for large healthcare bills

- CareShield Life / ElderShield for long-term care in case of severe disabilities

Considerations

For term life or critical illness coverage, you might want to consider:

- Customizable online term life insurance to complement and meet your existing death and permanent disability coverage

- Direct Purchase Insurance (DPI) is also available with no commission charged as this doesn’t come with financial advice

- Affordable online critical illness insurance or Cancer insurance in addition to your existing policies to help you bridge any coverage gaps

- Compare premiums and features of insurance products at compareFIRST.

Investments

Invest at least 10%** of your income^ for retirement and other financial goals

- Look into short-term investment opportunities or long-term investment opportunities based on your financial goals

Considerations

In addition to Singapore Savings Bonds, T-bills, Fixed Deposits, topping up your CPF retirement savings, or investing in Exchange Traded Funds, Unit Trusts, you can also consider investment or wealth accumulation products easily available online such as digital ILPs or endowment plans if they suit your risk appetite and investment horizon.

Look into Legacy Planning

Make your will and CPF nomination, and appoint trusted persons.

Considerations

Do note that you will need to make your nomination for your CPF savings as they do not form your estate and will not be covered by your will1. Without a CPF nomination, it can take up to six months for the Public Trustee’s Office to identify which of your family members are eligible to claim your savings. You can make your CPF nomination online.

Upgrading our financial literary is an important aspect of our personal finance journey. Using this guide while reviewing your financial plans can help with making more mindful choices and make the process a simpler one.

If you’re looking for a more customized guide that takes into account your needs at different life stages, keep a look out for 6 short guides that will be released in 2024. These guides will cover fresh entrants to the workforce, working adults with young children, working adults supporting aged parents, and those approaching retirement.

This is a basic guide and provides you with general steps to financial planning. If you’d prefer to take into consideration your specific needs, you may wish to speak to a financial advisory representative to explore your options.

[End]

** Purchase of bundled products (e.g. Whole Life Insurance), may exceed 15% of income as they contain both investment and protection elements.

^ After deducting CPF contributions

1 Central Provident Fund Board – Make a CPF Nomination

Information is accurate as at 12 January 2024.

ePROTECT term life, DIRECT – Etiqa term life II, 3 Plus Critical Illness, Cancer Insurance, Tiq Invest and Tiq 3-Year Endowment Plan are underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

These policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you.

As ePROTECT term life, DIRECT – Etiqa term life II, 3 Plus Critical Illness, and Cancer Insurance, have no savings or investment features, there will be no cash value if the policy ends or if the policy is terminated prematurely.

Tiq Invest is an Investment-linked Plan (ILP) which invest in ILP sub-fund(s). Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s).

A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from us via www.tiq.com.sg/product/tiqinvest. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act 1966 and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans.