- Geo-political uncertainties and slowing global growth are undermining market confidence

- Inflation has risen to multi-decade highs, eroding the value of money

- Singapore bonds offer investors the potential for less volatile, above-deposit returns over the medium term

- The United Singapore Bond Fund (USBF) is positioned for credit quality and yield enhancement

2022 is not going as planned

It has been a challenging start to 2022. After months of post-Covid market exuberance and optimism, worries started to weigh on equity sentiment late in 2021 and carried on into the new year.

In January 2022, investors were focused on the tightening path for central governments, given the so-called “transitory inflation”. Without the monetary stimulus in Singapore being helpful during the Covid period, investors were concerned that economic recovery might stall.

The onset of the Russia-Ukraine war in February turned these concerns into a crisis. Russia is a major energy and agricultural products exporter, and the imposition of sanctions has pushed oil (Brent crude) prices to over US$100 a barrel.

This in turn caused inflationary pressures to become stronger and stickier. April’s inflation in the US and Europe hit 7 – 8 percent, the highest rate in decades. In response, the US Federal Reserve (Fed) announced an aggressive rate hike schedule that is expected to reach 2 – 2.25 percent by end-2022, with more planned for 2023 and 2024.

What does this mean for financial markets?

1. Global equities have turned volatile

These uncertainties and tightening measures brought an end to the US and European equity markets rally. Instead, these markets have now turned highly jittery, affecting even the US’s mega-cap stocks. With no end in sight, global equity markets are unlikely to stabilise anytime soon.

2. Global bonds are underperforming

Global bond markets have also seen a deep sell-off since 2022 started. Two-year Treasury yields rose from near-zero a year ago to 2.3 percent as at end-March 2022. Ten-year Treasury yields are not rising as fast, resulting in a flatter yield curve than in the past. This suggests a lack of confidence in the economy.

3. Asian bonds showing some resilience

In Asia, where inflation is not rising as fast, the sentiment around Asian bonds is better. Asian bond yields are rising more slowly and spreads between Asian and US bonds have tightened slightly. Two-year Singapore government bond yields increased marginally to 1.84 percent as at end-March 2022.

Both bond and equity markets are looking volatile. As a defensive investor, what should I do?

It is tempting in uncertain markets to stay in cash. However, this is not an adequate long term solution given the following considerations:

1. Inflation hurts your spending power

Prices of goods and services are rising fast everywhere in the world. Already in many Asian countries, fixed deposit rates are not keeping pace with the scale of this rise.

Figure 1: Asia Inflation vs Deposit Rates

| Country | Inflation Rates, % | Deposit Rates, % |

| Thailand | 5.73 | 0.62 |

| South Korea | 4.1 | 1.8 |

| Singapore | 4.3 | 0.12 |

| Malaysia | 2.2 | 1.96 |

| Indonesia | 2.64 | 2.75 |

Source: Trading Economics, 13 April 2022, based on last available data

Even defensive investors should consider how to deploy their capital more efficiently to keep up with current inflation trends.

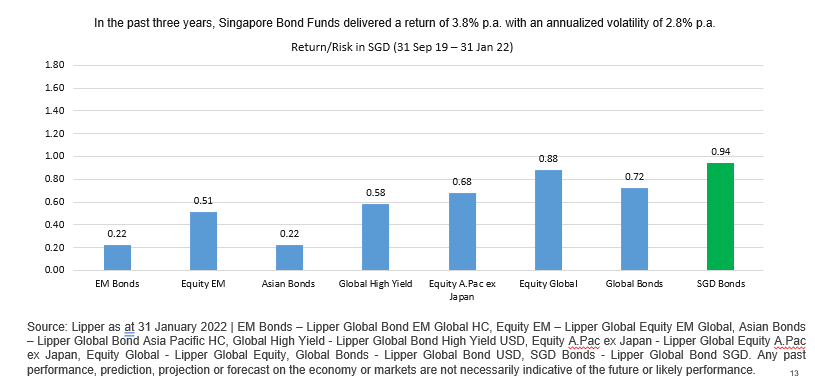

2. Singapore Bonds potentially offer higher return per unit of risk taken

Compared to other equity and bond sectors, Singapore bonds historically offer the highest potential return per unit of risk taken. Singapore bonds’ risk-adjusted returns are more than three times higher than Asian bonds.

Figure 2: Return/Risk in SGD (31 Sep 19 – 31 Jan 22)

In the past three years (31 January 2019 – 2022), Singapore Bonds delivered a return of 3.5% p.a. with an annualized volatility of 3.6%. (Source: UOBAM, Lipper, 31 January 2022)

The potential outlook for the SGD is positive

Many Asian currencies are in danger of weakening against the USD given the uptrend in US interest rates. However, the MAS (Monetary Authority of Singapore) is taking steps to tighten its monetary policy ahead of the country’s neighbours. This may lead to a potential SGD appreciation over the medium term.

Why should I consider the United Singapore Bond Fund?

The United Singapore Bond Fund (Fund) offers some distinctive features:

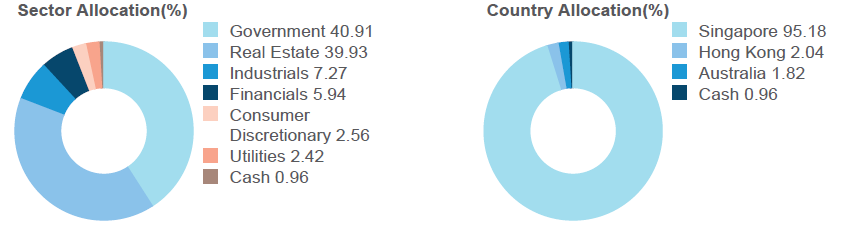

1. Focus on Singapore Government and Singapore Real Estate Bonds

The Fund invests mainly in Singapore government bonds and bonds denominated in SGD. The exposure to Singapore government bonds of different maturities provides the Fund with stability given their highest-possible (AAA) credit quality.

Figure 3: USBF Sector and Country Allocation

Source: UOBAM, as at 31 March 2022

Meanwhile, the exposure to real estate and other corporate bonds in Singapore may help to deliver higher yields. Real estate is a key sector for Singapore with a large number of bond issuances and high liquidity.

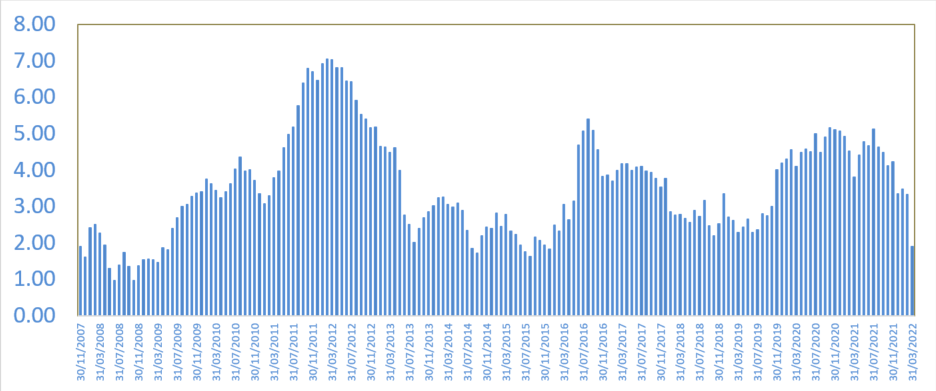

2. Positive 3-year rolling returns since inception

For a 3-year holding period, an investment into this Fund in any month since it was incepted has seen a positive return ranging from around 1 – 7 percent. (Past performance of the portfolio or UOBAM and any past performance, prediction, projection or forecast on the economy or markets are not necessarily indicative of the future or likely performance of the portfolio or UOBAM. Returns are calculated on a single pricing basis.)

Figure 4: USBF 3-year rolling returns (30 Nov 2017 – 31 Mar 2022)

Source: UOBAM, Morningstar Direct, as at 31 March 2022. Dates indicated are based on the end of a 3-year period. Rolling window: 3-years, 1-month shift.

The Fund has not seen any credit defaults or restructurings since its inception, as at 31 March 2022.

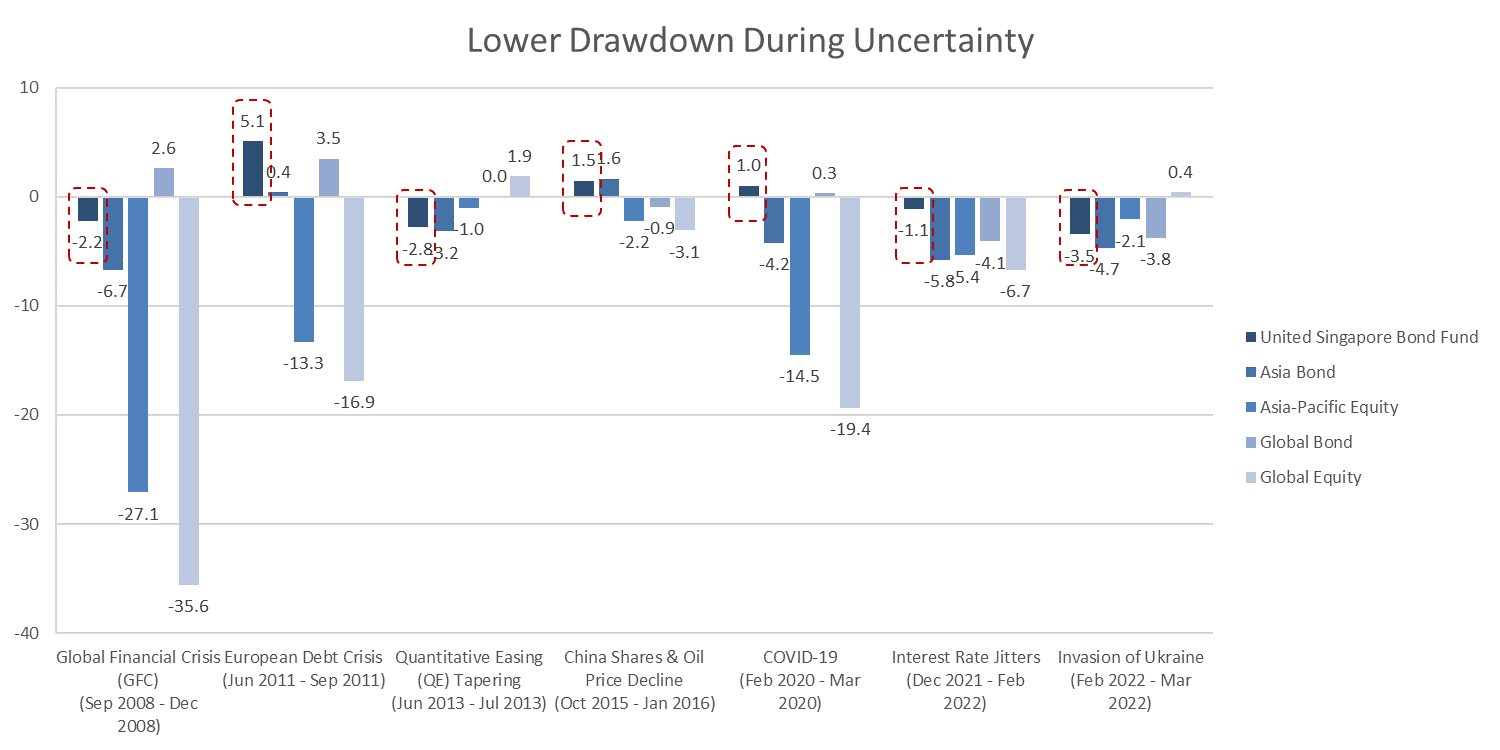

3. Less volatile returns

During periods of high certainty, from the global financial crisis to the Covid-19 crisis, the USBF has demonstrated its ability to outperform other asset classes and even other bond sectors.

Figure 5: USBF vs other asset classes, selected periods

Source: UOBAM/Morningstar, as at 31 March 2022.

The Fund’s strategy to invest in bonds of high credit quality, with a view to holding bonds to maturity, may help to stem any major price fluctuations.

What are the risks?

Not capital guaranteed

While the USBF is a low-volatility fund with no episodes of negative returns over a longer holding period, this is not necessarily the case over shorter holding periods. As such, investors should note that the fund does not guarantee capital preservation, and should aim to hold the fund for three years or more.

Potential to underperform in risk-on markets

Also, given its defensive qualities, the fund may underperform during periods of strong economic growth. However, as markets can turn volatile with little notice, the Fund may help to stabilise a portfolio in all market situations.

Interest rate rises

Besides credit quality and bond sectors, a bond fund’s duration can add to the fund’s price volatility. Duration is the degree to which a bond is affected by interest rate changes and is based on both a bond’s time to maturity as well as its coupon rate.

A bond portfolio’s duration is the weighted average of the individual bond durations in the portfolio, and in the case of the USBF is 7.86 years (as at 31 March 2022). This means that if Singapore interest rates rise by one percent, the fund could potentially lose 7.86 percent of its value.

How can I further lower the downside risks?

Fund diversification

To mitigate against the risk of interest rate rises, one option is to diversify further by adding the United SGD Money Market Fund (USMMF) to your portfolio. The USMMF invests in highly liquid, high quality and short term instruments of which 70 percent have an average maturity of six months or less. Non-SGD-denominated investments are hedged back to SGD. (Source: UOBAM, 31 March 2022)

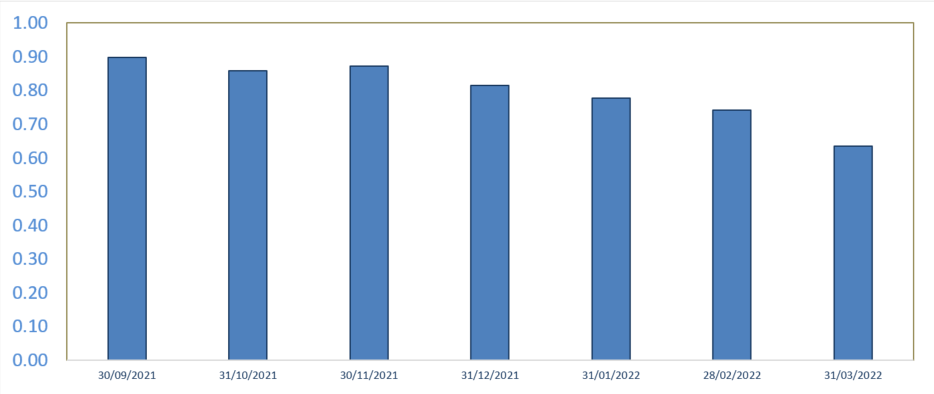

Figure 6: USMMF 3-year rolling returns (30 Sep 2021- 31 Mar 2022)

Source: UOBAM/Morningstar, as at 31 March 2022. Dates indicated are based on the end of a 3-year period. Rolling window: 3-years, 1-month shift.

The Fund’s 3-year rolling returns since inception has delivered steady positive returns.

The combination of the USBF and USMMF has the potential to provide stable above-deposit returns for a long term investor.

Important Notice and Disclaimers

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)’s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

In the event of any discrepancy between the English and Mandarin versions of this publication, the English version shall prevail.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z

This article is contributed by UOB Asset Management. All information is correct as at the date of publication on 26 May 2022. For more information, please visit uobam.com.sg.