Looking for a maid insurance policy to cover your new maid?

Here’s a tip: Choose an insurance package that not only adequately protects your maid with accident and medical coverage, but also guards you against liabilities and unexpected expenses.

Tiq Maid is a policy that does exactly that! It provides comprehensive coverage for both you and your helper, and is one of the most affordable plan in town. Here are 3 compelling reasons why you should choose Tiq Maid Insurance:

1. Tiq Maid Insurance’s comprehensive coverage gives you peace of mind

In Singapore, it seems like hardly a day goes by without news of an unfortunate incident involving a foreign domestic worker. Some maids sustain injuries while working at home, while others get into accidents on their days off. Accidents involving maids are more common than we realise.

With Tiq Maid Insurance, your helper is adequately covered with hospitalisation and surgical benefits in the event of an accident. You, as the employer, are also safeguarded against a wide range of risks.

Benefits for your maid

- Personal accident protection: Tiq Maid Insurance protects your maid with high policy cover for accidental death and permanent disability. For the lowest-tier plan, the coverage is $60,000 for accidental death; that for the highest-tier plan is $70,000. For medical expenses due to accidents or injuries, Tiq Maid Insurance covers up to $3,000.

- Hospitalisation and surgery: When an illness or accident happens, your maid can get the medical care she needs with Tiq Maid Insurance. The policy covers $15,000 per year for hospital and surgical bills. This benefit covers inpatient treatment and day surgery, as well as follow-up outpatient treatment, up to 90 days from the date of discharge.

- Repatriation: If your maid cannot work for you anymore due to illness or injury that has resulted in total permanent disability, you need to send her home. The plan covers $10,000 for repatriation expenses.

Benefits for you, the employer

- Termination or rehiring expenses: If you need to hire replacement help in the event of your maid’s permanent disability or death, Tiq Maid Insurance covers your termination or rehiring expenses up to $350.

- Wages and levy reimbursement: If your maid cannot work due to hospitalisation, you can claim pro-rata reimbursement of her salary and the maid levy, up to $30 per day.

- Alternative maid services: Need alternative help during your maid’s hospitalisation? Make use of the policy’s daily benefit (up to $20 per day) to help you do so.

- Recuperation benefit: Receive a daily benefit of up to $20 per day while your maid is hospitalised.

- Security bond: You don’t have to pay the Ministry of Manpower (MOM) the security bond of $5,000 upfront. Tiq Maid Insurance provides a Letter of Guarantee to MOM as your guarantor.

- Maid’s liability: If your maid accidentally causes bodily harm to a third party or accidentally damages a third party’s property, Tiq Maid Insurance provides you with indemnity of up to $10,000. You can also enhance the sum insured for this benefit to up to $75,000.

- Cover against abuse: Although it is uncommon, maids can sometimes abuse the families of their employers. This benefit, which is rare in other insurers’ policies, compensates you for up to S$5,000 in medical expenses if your maid abuses your child, elderly relative, or disabled relative.

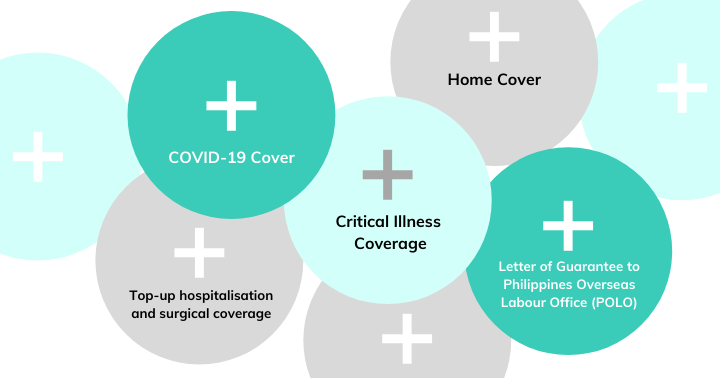

2. Tiq Maid Insurance can be customised with add-ons to meet your needs

Tiq Maid Insurance is very flexible, allowing you to tailor your policy to your maid’s and your own needs with useful add-ons. You can build a comprehensive plan that shields you and your maid from risks!

- COVID-19 coverage: It is prudent to be prepared for COVID-19 during in these unprecedented times. Tiq Maid Insurance covers your maid’s COVID-19 hospitalisation and surgical bills while she is on her Stay-Home Notice upon arrival in Singapore. Your maid will also receive free coverage for the side effects of the COVID-19 vaccine.

- Letter of Guarantee to Philippines Overseas Labour Office (POLO): If your maid is from the Philippines, she needs a Letter of Guarantee for her home leave every 2 years. We issue the letter to POLO on your behalf, so you don’t have to fork out the full $7,000 for the security bond.

- Critical illness coverage: We can’t predict what’s waiting for us around the corner, and a critical illness may strike anyone, anytime. Your maid can get a lump-sum payout of up to $20,000 if she contracts a critical illness.

- Top-up hospitalisation and surgical coverage: Medical and hospital bills can quickly mount if your maid sustains serious injuries or illnesses. As such, you may decide to add a sum insured of up to S$25,000 for hospitalisation and surgical charges.

- Home cover: If your home contents are damaged by a fire caused by your maid, or if they are stolen by your maid, we have you covered for up to S$20,000 with this add-on.

- *NEW* Additional infectious disease cover: Coverage against 22 Infectious Diseases, which include Dengue Fever, HFMD, SARS, and more.

3. Tiq Maid Insurance is super affordable

Tiq Maid Insurance is one of the most affordable maid insurance plans around. Let’s say your maid is from Myanmar. For a 14-month plan without any promotion applied, the lowest-tier plan costs only $184.55 while the highest-tier one is $222. And with the on-going 25% discount applied, these are easily among the cheapest maid insurance rates in Singapore.

Want to boost your policy with add-ons for even better coverage? Get an idea of how much your customised plan costs by using the quotation page.

Additionally, as a new customer, you can refer your friends to Tiq Maid Insurance and earn referral fees. Simply log into TiqConnect to share the referral code with them. When they apply the code during checkout, they enjoy a discount instantly. You then receive your referral fees, which you can use to buy Etiqa products or make withdrawals via PayNow or direct bank credit. That’s what we call a win-win!

Tiq Maid Insurance may just be the plan for you!

As the employer, you are responsible for your maid’s well-being and safety. But sometimes accidents not within our control do happen.

However, if your maid is protected with a quality insurance plan, the financial coverage ensures that she gets adequate medical care. She can also recuperate with greater peace of mind and you won’t be saddled with extra expenses.

Competitively priced with attractive benefits, Tiq Maid may just be the maid insurance plan for you and your maid. Check it out today!

[End]

Information is accurate as at 22 February 2023. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). Protected up to specified limits by SDIC (excluding Personal Cyber Insurance).

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.