The ongoing debate on Investment-Linked Policies (ILP) continues… “Why are ILPs so bad?” “Can my ILP make money?” “Should I cancel my ILP?” There are two sides to a coin, and if you’ve ever had these thoughts, read on to find out more about ILPs and digital ILPs, and why they may not be that bad after all.

What is an ILP?

As mentioned in this guide, an ILP is a package deal that combines investment and protection components into a single insurance policy. It is a life insurance plan that lets you invest, by purchasing units in one or more sub-funds of your choice, while also offering protection in the event of death.

Simply put, an ILP offers protection and an account value that varies depending on your investment performance. As with all investments, ILP comes with its share of risks. Some ILPs can be expensive with underlying fee structures and complexity, especially if you don’t know what you are doing with your investment.

What is a digital ILP?

Not all ILPs are made equal. A digital ILP refers to an investment-linked policy that can be purchased online without going through an agent. Without a 3rd party intermediary, it is often more affordable and often with simpler processes as compared to traditional ILPs.

An example is Tiq Invest, which was launched in 2021. Besides the convenience of being able to purchase it online, Tiq Invest offers flexibility and lower management fees, helping customers to save money and time.

Some risks you should know

Some risks you should know

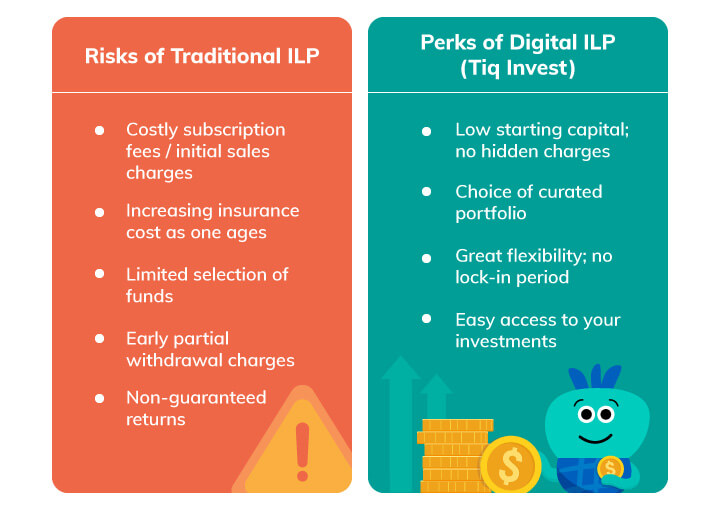

The many controversies surrounding ILPs deserve some exploration. Here are some risk factors involving the “invest + insure” policy:

Costly subscription fees / initial sales charges

Investing through an ILP comes with the flexibility of fund switching within the list of sub-funds offered by the insurance company. However, there are usually subscription fees / initial sales charges (when you buy) and redemption fees (when you sell) that can be expensive and affect overall returns in the first few years, making it less ideal for people with a short investment horizon.

Increasing insurance cost as one ages

As we age, we face a higher risk of developing diseases and health conditions, which raises insurance costs accordingly. Over time, the units purchased with your premiums may not cover your insurance expenses. You would need to adjust the balance of investment and insurance (protection) elements in your ILP to achieve the outcome you prefer.

Non-guaranteed returns

ILPs typically anticipate higher returns, but these rates are not guaranteed. Policyholders are exposed to the full investment risk and receive no guaranteed profits. As a result, policyholders must constantly examine their investment portfolio to ensure that it fulfils their financial objectives.

Limited selection of funds

For most ILPs, the range of available sub-funds are specially curated, and there is a limited number of unit-trust available for selection. More savvy investors may note that asset management or brokerage firms can offer far more fund choices.

Early partial withdrawal charges

Early partial withdrawal charges

In many instances, withdrawal or surrender of an ILP is not allowed in the first few years from the policy start date, or there will be early partial withdrawal charges imposed. Similar to some participating plans such as endowment or whole life plans, the surrender value in the first few policy years for ILP could be very low.

Why are digital ILPs not so bad?

If ILPs were that bad, why are there so many of them in the market, and why do people continue to buy them? Truth be told, an ILP may not be as horrible as you imagine. The question is whether the ILP you’re looking at is appropriate for your needs. With digital ILPs redefining user experiences to meet changing needs, you might want to learn more about this relatively new technology.

When digital ILPs were created, they addressed some of the pain points of traditional ILPs. For example, Tiq Invest features greater accessibility to funds, flexibility to manage investments, and life protection while keeping fees minimal. In fact, their fees are some of the lowest in the market. No agents’ commissions are charged either. Here’s what you can expect:

Low starting capital; no hidden charges

With just a single premium of S$1,000, you can start investing with Tiq Invest. You only need to take note of the low management fee of 0.75% per year.

Beyond that, Tiq Invest does not impose additional charges for fund switches, partial fund withdrawal, or a full surrender. 100% of what you invest goes directly into the purchase of funds. Your dividends are also reinvested so you enjoy more growth!

Easy access to your investments

While traditional ILPs are managed with the help of an agent, Tiq Invest digital ILP provides easy access to your investments so that you can track and transact directly, either through TiqConnect or the Tiq by Etiqa mobile app. In fact, you can easily monitor the Packaged Fund prices here! Having easy access to your investments allows you to act quickly to snag opportunities or cut losses.

Choice of a curated portfolio

Investing can be complex when there are too many choices. Digital ILPs somewhat resemble robo-advisors in the sense that they offer curated portfolios of varying risks and to suit different financial objectives. That’s where the similarity ends for Tiq Invest, as its funds are managed by dedicated specialists and are in the professional hands of Etiqa Insurance. No pre-set algorithms or bots!

Tiq Invest offers investors a choice of 4 different packaged funds, namely Conservative, Moderate, Growth, and Aggressive. These are specially curated portfolios to match risk tolerance and desired rates of returns.

Great flexibility; no lock-in period

Flexibility is one of the key features of Tiq Invest, as well as many of our online direct purchase products. This fluidity comes in the form of no lock-in period, and the option to switch funds (as mentioned before) without any charges.

With a low starting capital, transparent rates, and great flexibility, Tiq Invest offers a simplified way to invest and insure, especially for new investors. Learn more here.

[End]

This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

Tiq Invest is an Investment-linked Plan (ILP) which invest in ILP sub-fund(s). Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The performance of the ILP sub-fund(s) is not guaranteed and the value of the units in the ILP sub-fund(s) and the income accruing to the units, if any, may fall or rise. Past performance is not necessarily indicative of the future performance of the ILP sub-fund(s).

A product summary and product highlights sheet(s) relating to the ILP sub-fund(s) are available and may be obtained from us via www.tiq.com.sg/product/tiqinvest. A potential investor should read the product summary and product highlights sheet(s) before deciding whether to subscribe for units in the ILP sub-fund(s).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC web-sites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is accurate as at 30 January 2024.

Tiq by Etiqa Insurance Pte. Ltd.

A digital insurance channel that embraces changes to provide simple and convenient protection, Tiq’s mission is to make insurance transparent and accessible, inspiring you today to be prepared for life’s surprises and inevitabilities, while empowering you to “Live Unlimited” and take control of your tomorrow.

With a shared vision to change the paradigm of insurance and reshape customer experience, Etiqa created the strong foundation for Tiq. Because life never stops changing, Etiqa never stops progressing. A licensed life and general insurance company registered in the Republic of Singapore and regulated by the Monetary Authority of Singapore, Etiqa is governed by the Insurance Act and has been providing insurance solutions since 1961. It is 69% owned by Maybank, Southeast Asia’s fourth largest banking group, with more than 22 million customers in 20 countries; and 31% owned by Ageas, an international insurance group with 33 million customers across 16 countries.

Discover the full range of Tiq online insurance plans here.

Some risks you should know

Some risks you should know Early partial withdrawal charges

Early partial withdrawal charges