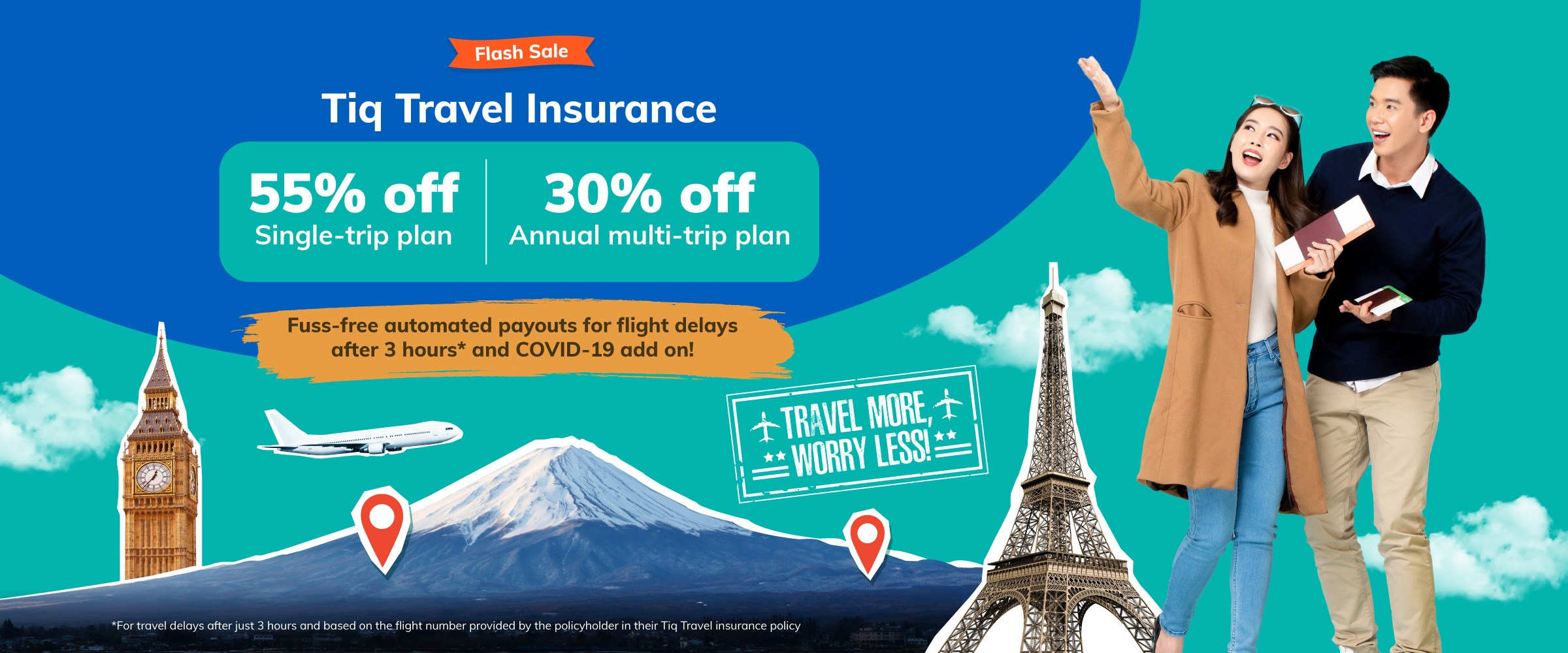

Travel More, Worry Less with Tiq Travel!

Don’t let unexpected events dampen your getaway. Travel with peace of mind with Tiq Travel Insurance from just $10.75* so you can focus on making memories, not managing mishaps. Whether it’s a quick escape or multiple holidays this year, Tiq has you covered.

From overseas medical emergencies to travel inconveniences like flight delays and lost belongings, we’ve got your back. Customise your plan with flexible add-ons including pre-existing medical conditions, COVID-19 coverage, rental car excess, and more for a smoother, worry-free trip.

Current Promotion

How to win

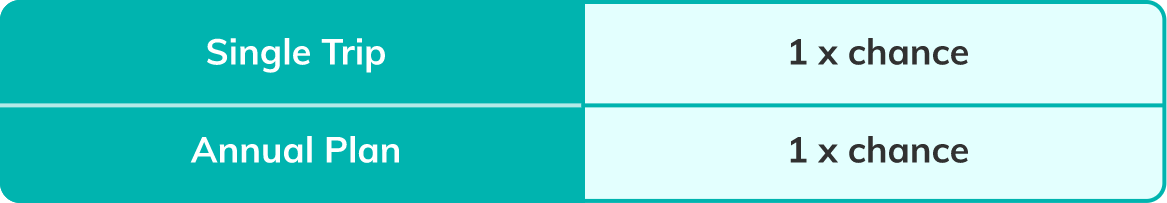

Buy Tiq Travel Insurance, every policy gives you 1 x chance to win

Ensure that you do not cancel your policy subsequently

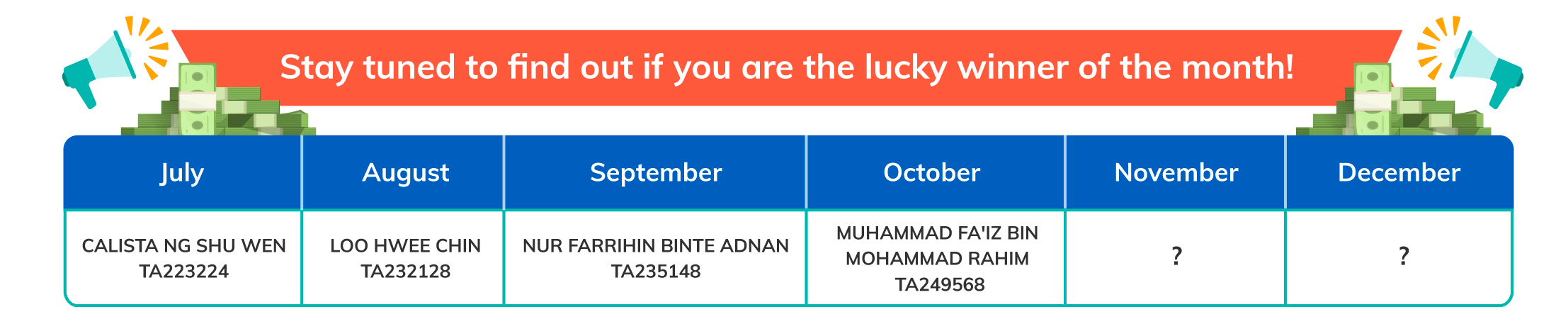

Stay tuned to find out if you are the lucky winner to win S$3,000 cash

Promo ends 3 March 2026!

*Based on 1-day ASEAN, Entry Plan with 45% off single-trip Tiq Travel Insurance.

Important Notes:

This policy is underwritten by Etiqa Insurance Pte. Ltd. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the General Insurance Association (GIA) or SDIC websites (www.gia.org.sg or www.sdic.org.sg).

Information is accurate as of 24 February 2026.

Be the first to know

Get the latest promotions and news

I consent and agree for Etiqa Insurance to collect, use and disclose the personal data above for the purposes of validation and sending, via telephone calls and text message. Read Etiqa's Privacy Policy [here]

Subscription Successfully.

Subscription Failed.