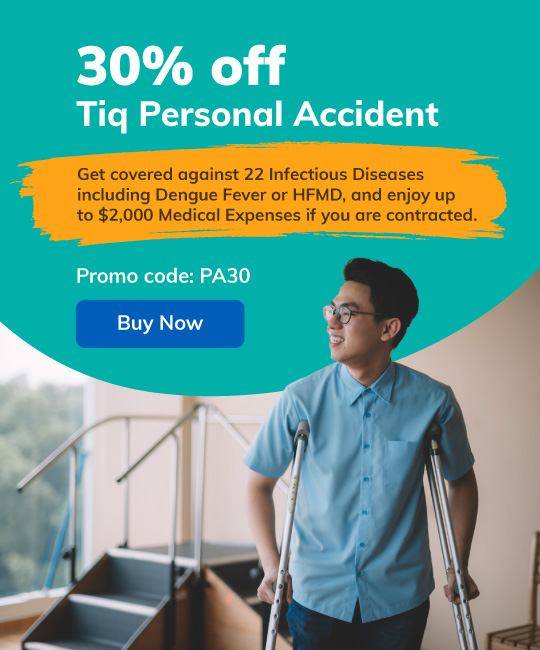

Experience peace of mind and get 30% off Tiq Personal Accident now!

Our comprehensive coverage shields you from medical expenses caused by injuries, infectious diseases, disability, and provides financial support in the face of accidental death.

You get to choose coverage that tailors to your lifestyle. Trust Tiq for robust protection against life’s unexpected events – your safety is our priority!

| Phases of an accident | Benefits under Tiq Personal Accident |

|---|---|

| Evacuation from accidental scene |

|

| Treatment in hospital or consultation with a general practitioner |

|

| Rehabilitation |

|

| Accidental Death (*Touch wood*) |

|

Benefits shown are based on Enhanced Platinum Plan. Please refer to the policy wording for more details.

That is why we have included COVID-19 coverage

| Benefit | Coverage |

| COVID-19 Home Recovery Cash benefit | $50 one-time benefit (outpatient medical expenses upon diagnosis) |

| COVID-19 Hospital Cash benefit | $50 per day (up to 15 days) |

We will pay you $50 one-time benefit if you are contracted with COVID-19 and is certified by a doctor. No hospitalisation is required.

Get all-year round peace of mind and enjoy 30%* off when you sign up today!

Key in Promo Code [PA30] to enjoy the discount.

Important notes:

This policy is underwritten by Etiqa Insurance Pte. Ltd. This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the General Insurance Association (GIA) or SDIC websites (www.gia.org.sg or www.sdic.org.sg).

Information is accurate as at 1 April 2024.

Be the first to know

Get the latest promotions and news

I consent and agree for Etiqa Insurance to collect, use and disclose the personal data above for the purposes of validation and sending, via telephone calls and text message. Read Etiqa's Privacy Policy [here]

Subscription Successfully.

Subscription Failed.