Enrich aspire VII

Guaranteed Maturity Yield of 2.01% p.a. for 5 years.

If you’d like to learn more about our upcoming tranche and savings products, leave us your contact and we’ll be in touch soon!

You will be notified ahead of our upcoming tranche launch!

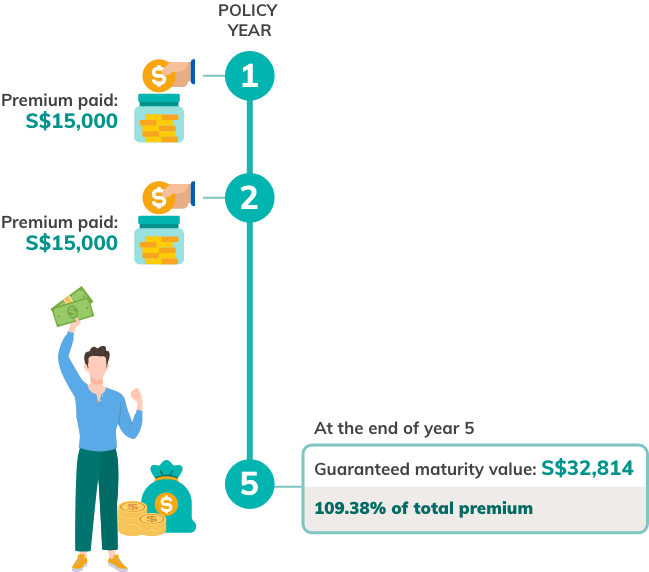

Enrich aspire VII is a 5-year short-term endowment plan that provides you with guaranteed returns of 2.01% p.a. upon maturity. Begin saving from S$10,000 per year for a premium term of 2 years.

Limited Tranche, Don't Miss Out!

Attractive guaranteed returns of 2.01% p.a. at maturity

Enjoy attractive guaranteed returns with a lump sum payout at the end of 5 years.

Lump sum payout upon death

Stay protected with life coverage of 101% of the total premiums paid.*

Hassle-free application

Guaranteed issuance with no medical examinations required.

How it works

2 years premium payment

Before Applying

Verification

Verify via Myinfo or Snap photos of the front and back of your NRIC/FIN Pass

Proof of Address

For non-Singaporean only. Submit a copy of your proof of address (from bills or statements)

Online Payment

Pay via DBS/POSB bank account, PayNow or FAST transfer

Have questions? We’re here to help

Committing to a financial product can be stressful, but we are here to make it easier!

Our operating hours are: Monday to Friday, 9.00am to 5.30pm (excluding public holidays)

Please enter your name

Please select an option

Please enter a valid email address

Please enter your mobile number

Please enter a date

Useful Information

Product Summary

Policy Contract

See What Our Customers Say

Featured Articles

Important notes:

This policy is underwriting by Etiqa Insurance Pte. Ltd. This advertisement has not been reviewed by the Monetary Authority of Singapore. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. As this product has no savings or investment feature, there is no cash value if the policy ends of if the policy is terminated prematurely. It is usually detrimental to replace an existing policy with a new one. A penalty may be imposed for early termination and the new plan may cost more or have less benefit at the same cost. This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit us the Life Insurance Association (LIA) or SDIC web-sites (www.lia.org.sg or www.sdic.org.sg). This product pays the same level of benefit regardless of severity of the condition, hence LIA’s common definition for the severe stage does not apply. This content is for the reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

Information is correct as of 4 September 2025.